One of the most significant recent advances in the investment industry has been how online brokers offer their clients access to user-friendly but exceptionally powerful trading platforms. Retail investors can now access dashboards of a quality that was once the preserve of professional traders at big investment houses. Two of the most popular platforms are cTrader and MT4; at their core, they do the same job of booking trades and reporting positions, but there is a lot more to them than that. With many brokers offering the two platforms, considering the pros and cons of cTrader vs MT4 can help you set up correctly and optimise your returns.

MT4 and cTrader are designed to cater for a wide range of trading strategies and support trading in numerous financial instruments. MetaQuotes Software Inc. operates MetaTrader MT4, and cTrader was developed by Spotware Systems Ltd, with both firms offering the platforms under licence to online brokers. MT4 first came to the market in 2005, and cTrader in 2011. Since then, both systems have continued to be upgraded and user-tested to an exceptionally high level, meaning they are robust, trustworthy, and packed full of state-of-the-art trade support tools.

Trading with cTrader

It’s no coincidence that the cTrader platform is offered by some of the most well-regarded brokers. High-quality firms such as Pepperstone, IC Markets, FxPro, and FP Markets have built their client base by focusing their offering around the cTrader platform. It’s a top-of-the-range trading platform packed with features designed to enhance the trading experience. It can be accessed using a WebTrader portal, in a downloadable desktop version, or app form for handheld devices.

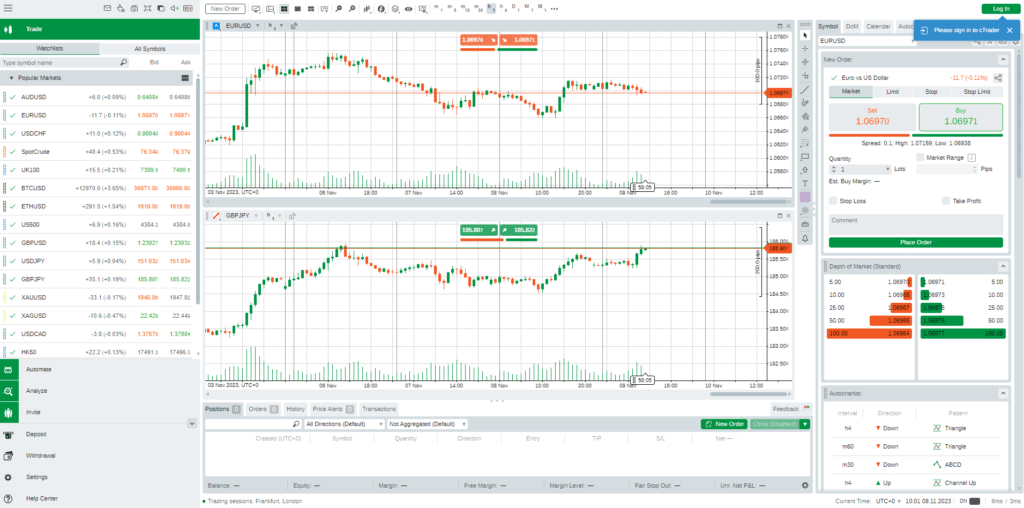

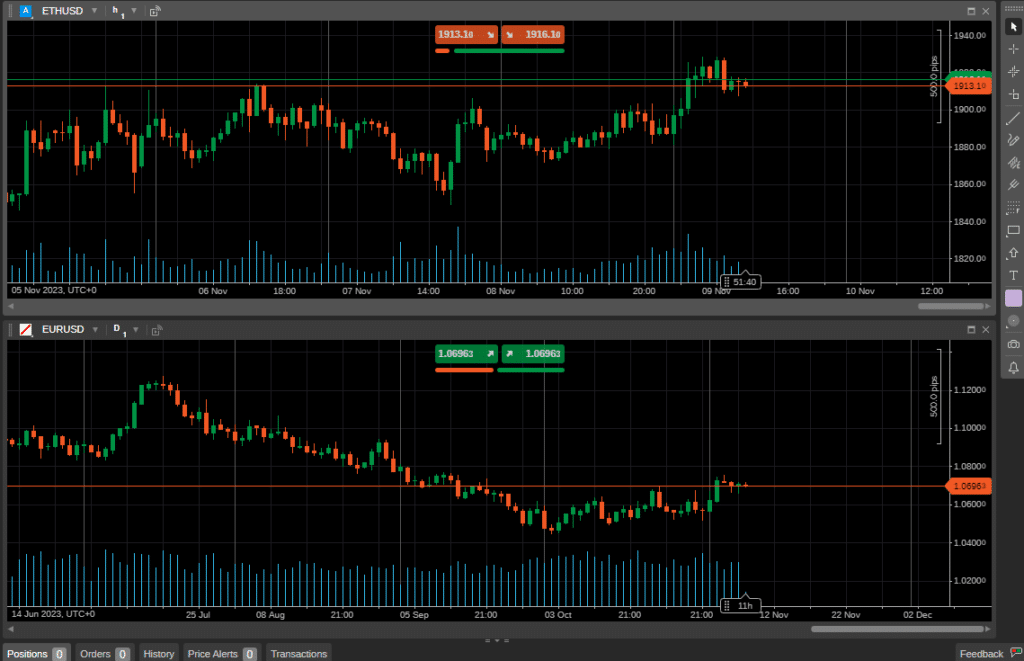

In line with standard market practice, the left-hand sidebar of the main dashboard details markets available to trade and the main trade execution interface is in the top right-hand corner of the screen. The centre of the screen is reserved for price charts, with a range of multiscreen layouts being available. But the right-hand toolbar is the key to cTrader’s success and where some of the platform’s strongest features can be found.

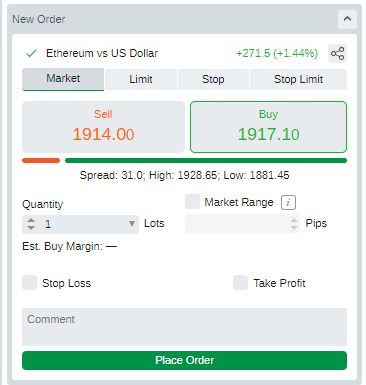

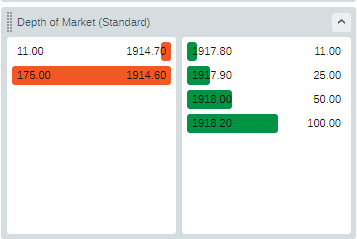

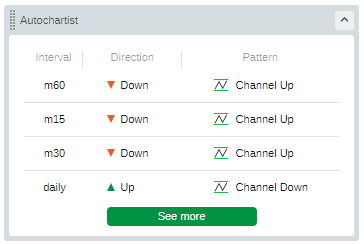

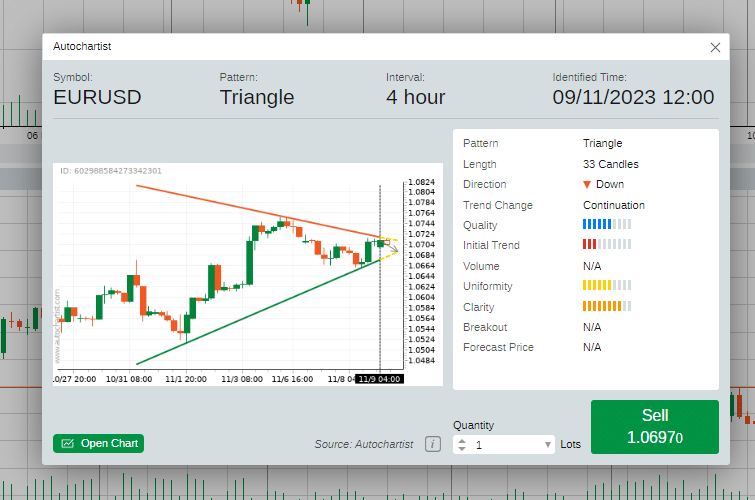

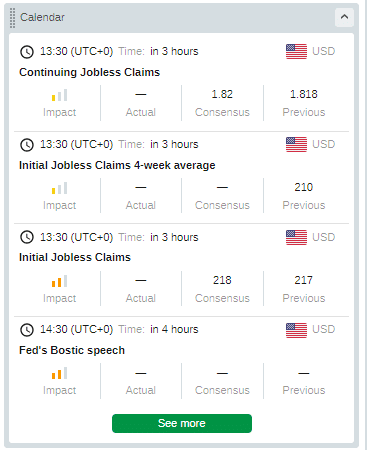

A Depth of Market monitor shows the size of the pending buy and sell orders ready to come into play should price move from current levels. It offers an indication of where the ‘real’ money in the market is positioned. The AutoChartist monitor also found on the right-hand sidebar, includes details of possible trade entry points based on technical analysis, with a series of strategy ideas for every market. Finishing off the display is an Economic Calendar pinpointing important upcoming news announcements and grading their significance according to which market is being traded.

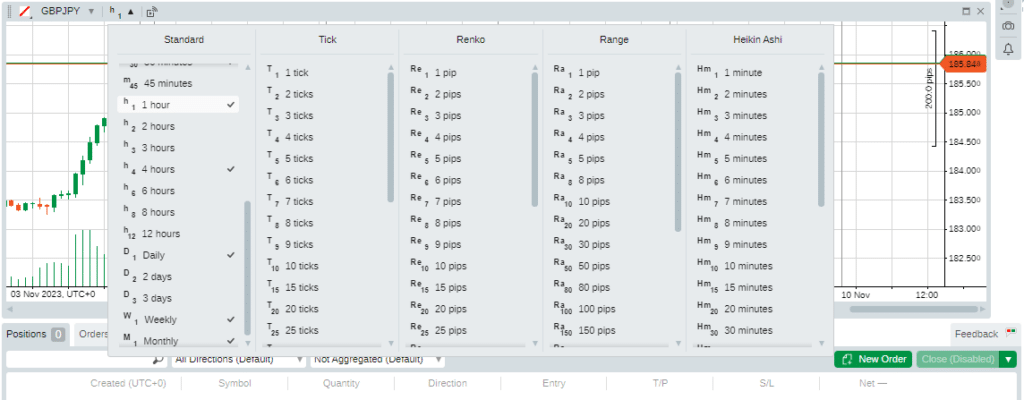

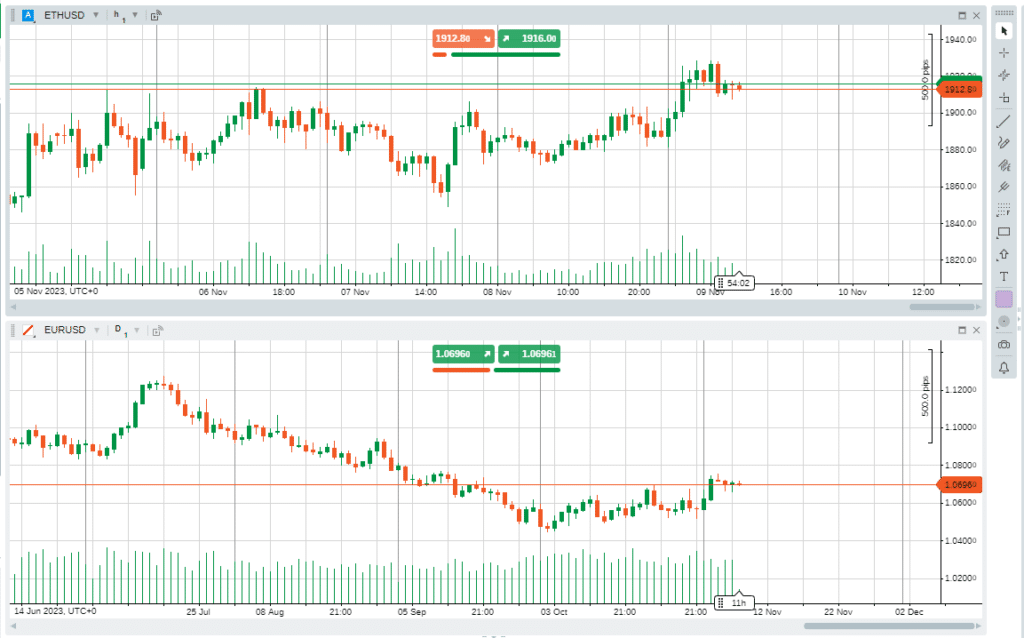

Price charts can be set to an impressive 26 different timeframes, supporting strategies running over minutes or months. The multiscreen layout allows you to monitor different markets simultaneously or the same market over different timeframes.

Trading with MT4

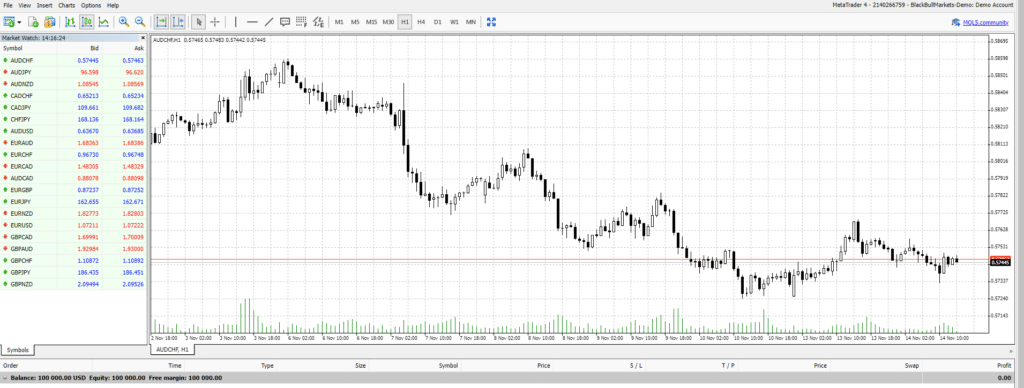

MT4’s role in the online investing space is possibly best demonstrated by the fact that more than 90% of online brokers offer the platform to their clients. Some brokers also provide alternatives, but in many cases, the MT4 platform is the only option, which reaffirms the view that for many users, MT4 is the only platform needed to trade the markets successfully.

The ubiquitous nature of MT4 can sometimes lead to new traders underestimating the platform’s potential. Whilst in-house developed platforms can offer unique features, MT4’s strengths are more than just familiarity, and the head start it gained by being the first platform to take online trading to the next level.

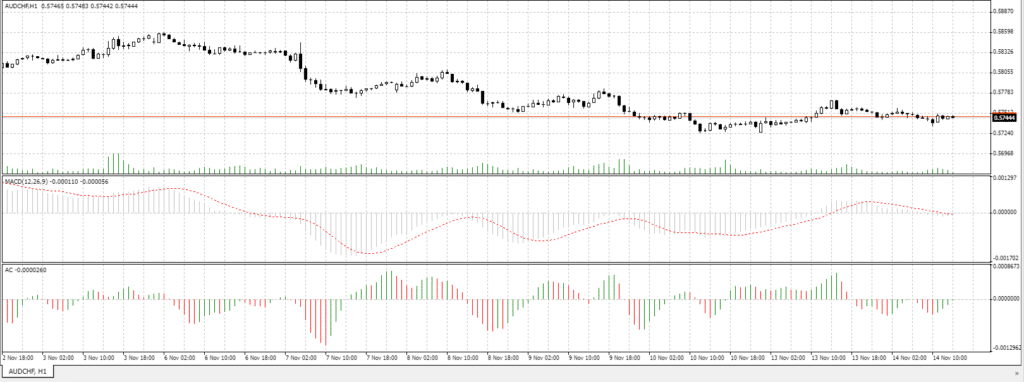

The core appeal of MetaTrader is the extensive range of technical analysis tools and indicators that allow traders to research and identify trading opportunities. More than 30 indicators, such as RSI, MACD, and Bollinger Bands, are included in the default package. Others, developed by third parties, can be downloaded and incorporated into your trading dashboard. Each one of these indicators can be applied to or removed from the trading dashboard with the click of a button, allowing you to set up your screen to run any strategy in any market conditions.

Trade indicators can also be used as part of automated trading strategies. With the Expert Advisors service and user-friendly MQL5 coding protocols of the platform, traders can set their account to enter into and trade out of trades whenever predetermined metrics are encountered. With ’emotional trading’ being blamed for many traders losing money, setting up a strategy and leaving it to run its course can look like a good alternative. MT4 remains the natural home of traders looking to adopt such a systematic approach.

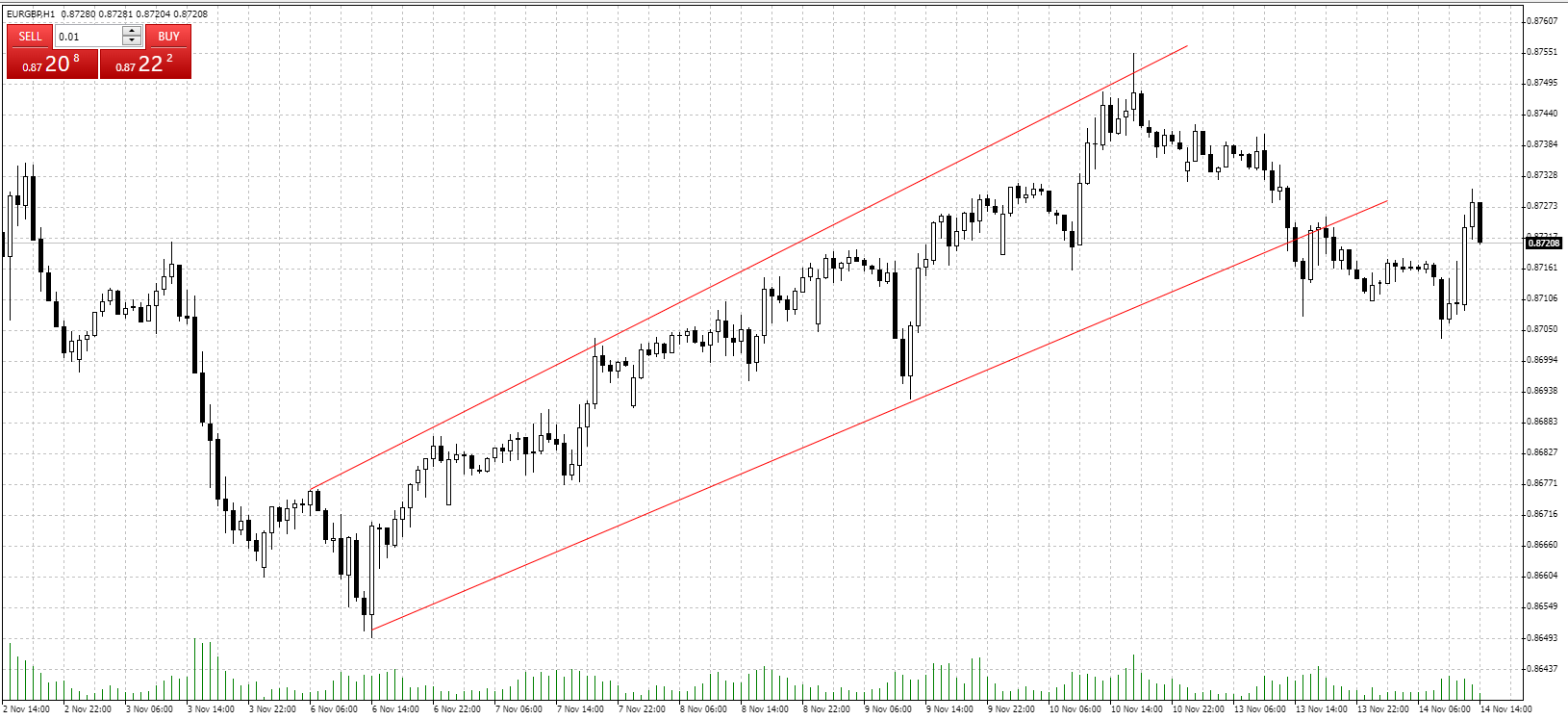

For those looking to trade manually using charting techniques, there is an array of graphics tools that can be used to annotate charts, and the on-chart trading interface and option of one-click trading means that trades can be booked instantly.

It’s possibly surprising that almost 20 years after MT4 was first introduced, even recently developed platforms follow the template laid out by the original, and some would say, the best trading platform in the market. That is due to the design features of MT4, the way navigating across markets and booking trades is highly intuitive, and the reliability it offers.

For many traders, MT4 provides everything they need to trade the markets and nothing they don’t. That results in the trading dashboard remaining uncluttered whether you are using the WebTrader, downloadable desktop, or mobile version of the platform.

What are the differences between cTrader and MT4?

One of the most obvious differences between the cTrader and MT4 platforms is the visual layout of each. The default settings for cTrader are more colourful, whereas MT4 has a clinical feel. That can be a factor which becomes increasingly important if you’re likely to be trading frequently.

The streamlined and razor-sharp graphics of MT4 can be advantageous if you’re using charting techniques – trendlines, indicators, and other metrics can all be set to exact positions. cTrader can also be used to run charting strategies but doesn’t quite offer the same surgical level of clarity.

cTrader does have the edge over MT4 in terms of the additional research and analysis tools, which are conveniently kept close to hand. The sidebars of the trading dashboard are packed full of monitors and indicators, which can be accessed instantly to help you keep on top of the markets. Having Depth of Market in view allows you to see the direction markets are heading in real-time, and AutoChartist provides access to trading ideas and strategy set-ups, which form through the course of a trading session.

The trading experience between the two can also be different. Both platforms support one-click trading, but the enhanced functionality of cTrader allows you to set stop-loss and limit-order levels by dragging the mouse across the price chart. MT4, of course, will enable you to input the same instructions, but that is done manually using data entry fields.

Which is Better for Trading Forex?

Both cTrader and MT4 platforms are incredibly popular with forex traders. MT4’s earlier introduction to the market resulted in it gaining a ‘first mover’ advantage. Many traders who started by trading currency markets using MT4 have found little reason to move away from what is still MetaTrader’s flagship platform.

The adage that ‘if it’s not broke, don’t fix it’ certainly seems to apply. There are estimated to be over 40m active MT4 users, accounting for approximately 32% of the global retail forex market. The way MT4 has cemented its position in the market is best demonstrated by the fact that the MT5 platform, which was rolled out in 2010 and was intended to be an upgrade on MT4, still has 30m fewer users than MT4.

MT4 is a good fit for the forex markets because currency markets tend to be highly liquid, and bid-offer spreads exceptionally tight. Forex markets are, therefore, a good choice for those running day-trading strategies regularly trading in and out of positions. The finely tuned graphics and extensive range of indicators make MT4 a good fit for that approach, but cTrader’s additional timeframes will appeal to scalpers.

cTrader does well to turn its second-generation approach to its advantage. It has managed to include some research features MT4 doesn’t have and is unlikely to introduce. It also supports a broader range of asset types, so forex traders can balance portfolios by incorporating positions in other types of instruments. In addition, cTrader’s softer graphics will, to many users, have a more user-friendly feel.

The cTrader platform, like MT4, can be set up to support copy trading and automated trading, but thanks partly to legacy issues, a greater number of systematic traders use the MT4 platform. That means the MetaTrader platform is associated with a larger and more established community of traders willing to share ideas and trading models with others. Many of the members of that community would also state that MT4 is a better choice for automated trading thanks to the coding protocols used on the MT4 platform being more user-friendly than those of the C# programming language.

The decision on which is better, cTrader or MT4, ultimately comes down to personal preference. That relates to the platforms’ functionality and which markets you want to trade. The good news is that both platforms can be set up and tested using a Demo account, so those considering which to use can conduct extensive testing before committing real funds.

The Best cTrader Brokers

Once you’ve established that the cTrader platform is the best for you, the next step is to choose a trustworthy broker that offers the terms and conditions that best support your trading style.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

The Best MT4 Brokers

If your research points to MT4 being the ideal platform to support your trading strategies, choose a regulated broker offering a range of additional services to help you get the most out of your trading.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Final Thoughts

The online trading industry has been revolutionised by brokers offering investors convenient ways to gain exposure to various financial markets. That led to professional-grade trading platforms being developed which are intuitive, easy to use, and packed full of powerful software tools.

Of these platforms, MT4 has for many years been the benchmark by which other platforms have been measured. Its enduring appeal is so strong that many are happy to accept that some of the aspects of the platform now appear slightly outdated.

MetaTrader’s upgrade of their platform, MT5, has even failed to dislodge MT4 from its preeminent position regarding user numbers, and cTrader user numbers are far less impressive than MT4’s. But that doesn’t mean that cTrader is in any way inferior. In fact, for many traders, the more recently introduced cTrader platform has the edge over MT4. The simplest conclusion is that both cTrader and MT4 have proven themselves to be top-grade platforms, and the best way to solve the cTrader vs MT4 debate is to try out both platforms and establish the best fit for your particular trading style.

Related Articles

- How To Use Expert Advisors in MT4

- How to Set Stop-Loss and Take-Profit in MT4

- MT5 – Designed to Do What MT4 Couldn’t

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.