FOCUS ON: US Jobs Report Set to Cap Off a Busy News Week

- July US Non-Farm Payrolls jobs report due on Friday

- Tech giants Apple and Amazon update investors on recent earnings

- Euro GDP data due on Monday is also likely to trigger increases in price volatility

Traders face a busy news week that will peak on Friday when the US Non-Farm Payrolls jobs report will be released. Before that, Eurozone GDP and PMI (Purchasing Managers Index) updates can be expected to increase price volatility. The earning season continues, with Apple and Amazon set to update investors.

Forex

GBPUSD

The Bank of England will update the markets on interest rate policy on Thursday. The most recent inflation report out of the UK suggested price pressure could be easing, and the consensus among analysts is that the Bank will increase UK base interest rate levels by ‘just’ 0.25%. Any move other than that will be considered a surprise and result in moves in the price of GBPUSD.

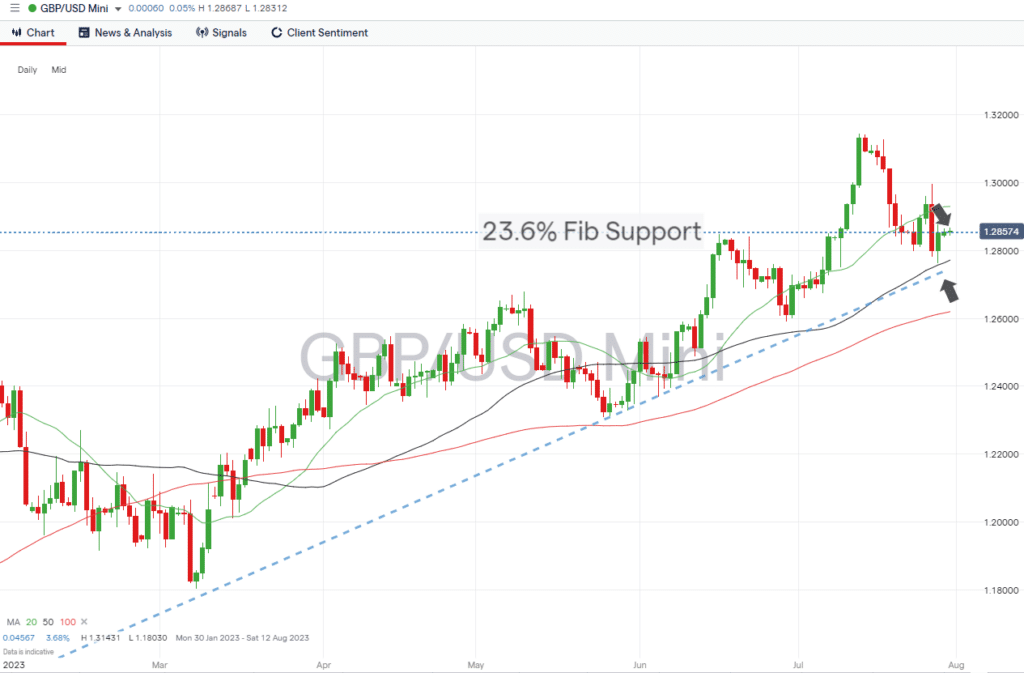

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Fib Level Resistance/Support

Source: IG

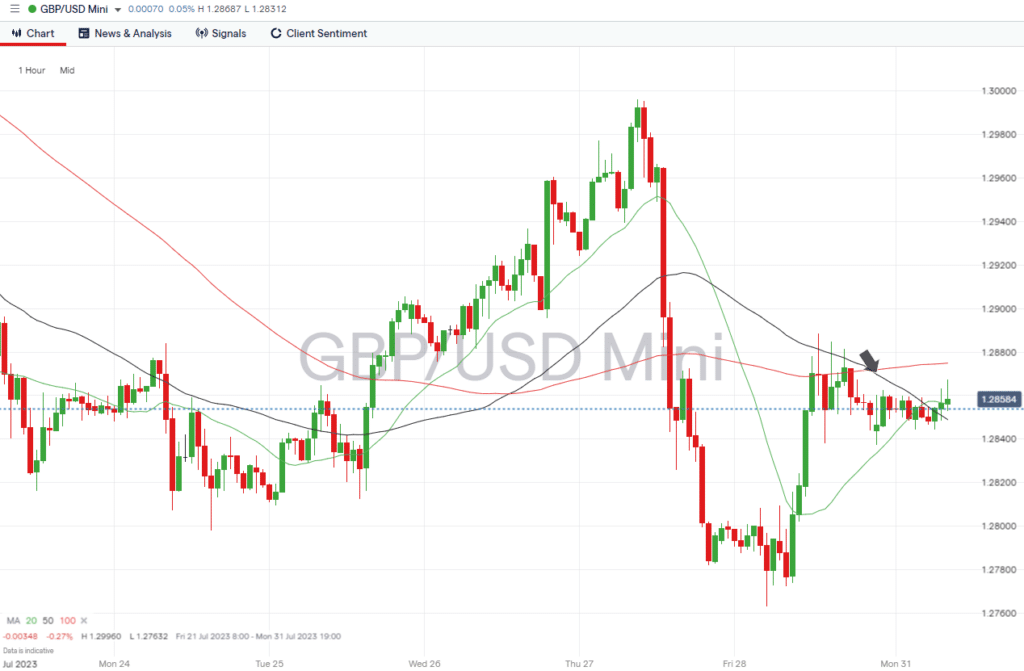

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Tuesday 3rd August – 12:00 pm BST – Bank of England Interest Rate Decision. Analyst consensus is that base rates will increase by 25 basis points.

- Thursday 3rd August – 3:00 pm BST – US ISM Services PMI. Index expected to fall to 52 from 53.9.

- Friday 4th August – 1.30 pm BST – US Non-Farm Payrolls (July). Payrolls are expected to rise 190,000 from 209,000 in June, and unemployment levels to remain unchanged at 3.6%.

EURUSD

Most news relevant to traders in the Eurodollar market will be released in the first half of the week. The significant EU GDP figure for Q2 is released on Monday, and German unemployment numbers follow on Tuesday. The US Non-Farm Payrolls numbers due on Friday can also be expected to influence the price of EURUSD.

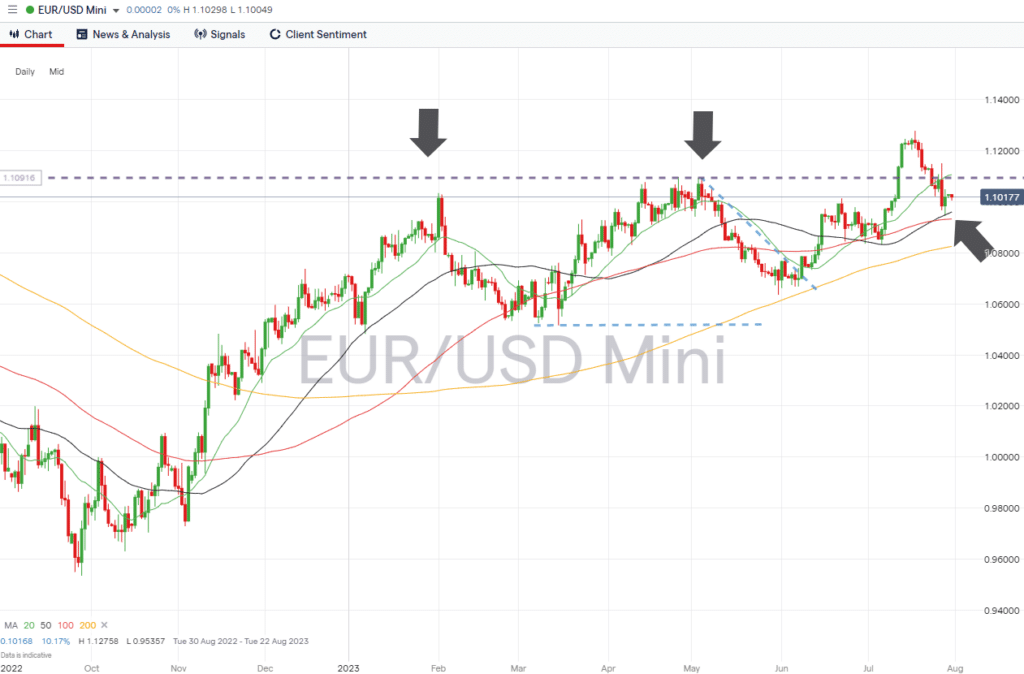

EURUSD Chart – Daily Price Chart

Source: IG

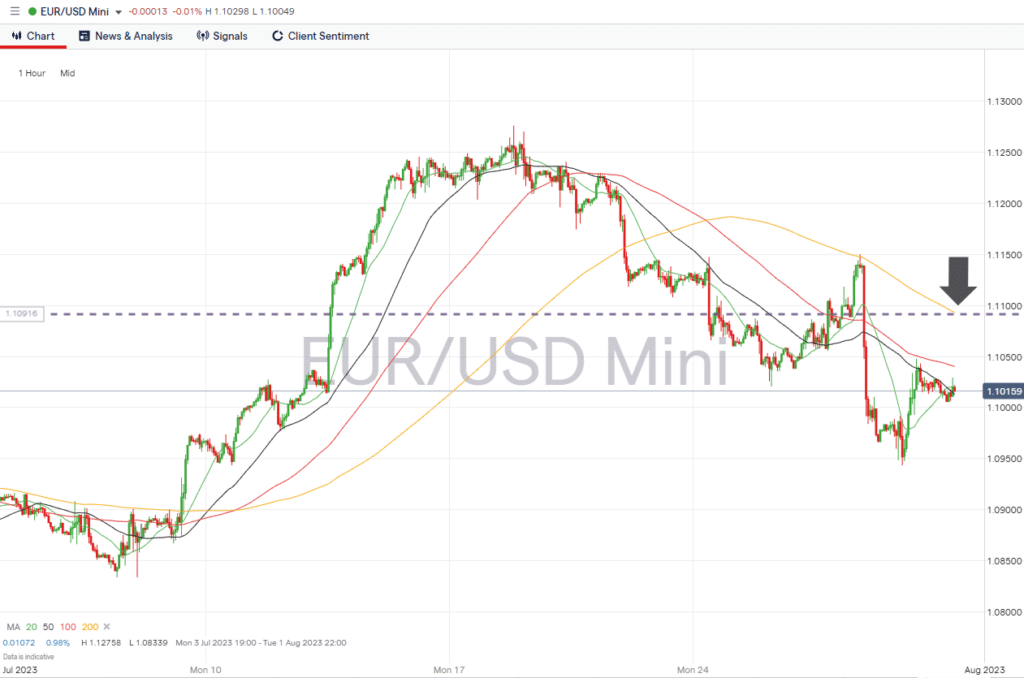

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Monday 31st July – 10:00am BST – Eurozone GDP Q2. Analysts expect GDP to have grown 0.3% quarter-on-quarter and 0.6% year-on-year.

- Tuesday 1st August – 8:55am BST – German Unemployment (July). Unemployment forecast to remain unchanged at 5.7%.

- Thursday 3rd August – 3:00pm BST – US ISM Services PMI. Index expected to fall to 52 from 53.9.

- Friday 4th August – 1:30pm BST – US Non-Farm Payrolls (July). Payrolls expected to rise 190,000 from 209,000 in June, and unemployment levels to remain unchanged at 3.6%.

Indices

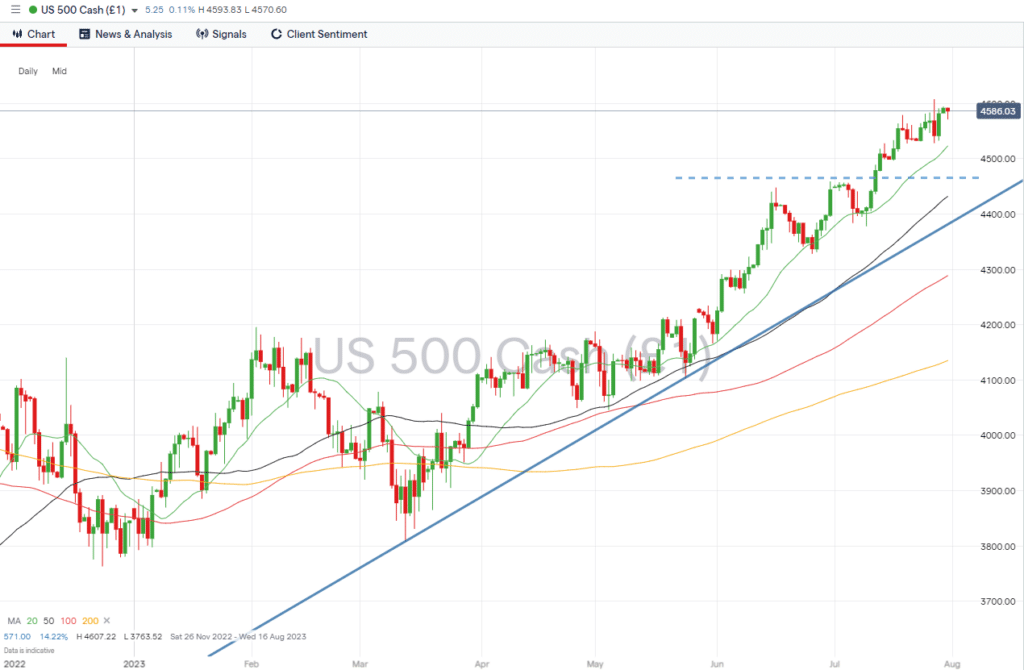

S&P 500

US stock investors will have one eye on the Non-Farm Payrolls report released on Friday, but in the run-up to that major announcement, some of the biggest names in the US stock market will be updating investors regarding last quarter’s earnings. Amazon and Apple are considered bellwethers of the US stock market, so their reports can be expected to have implications for stock prices across all sectors.

S&P 500 Chart – Daily Price Chart

Source: IG

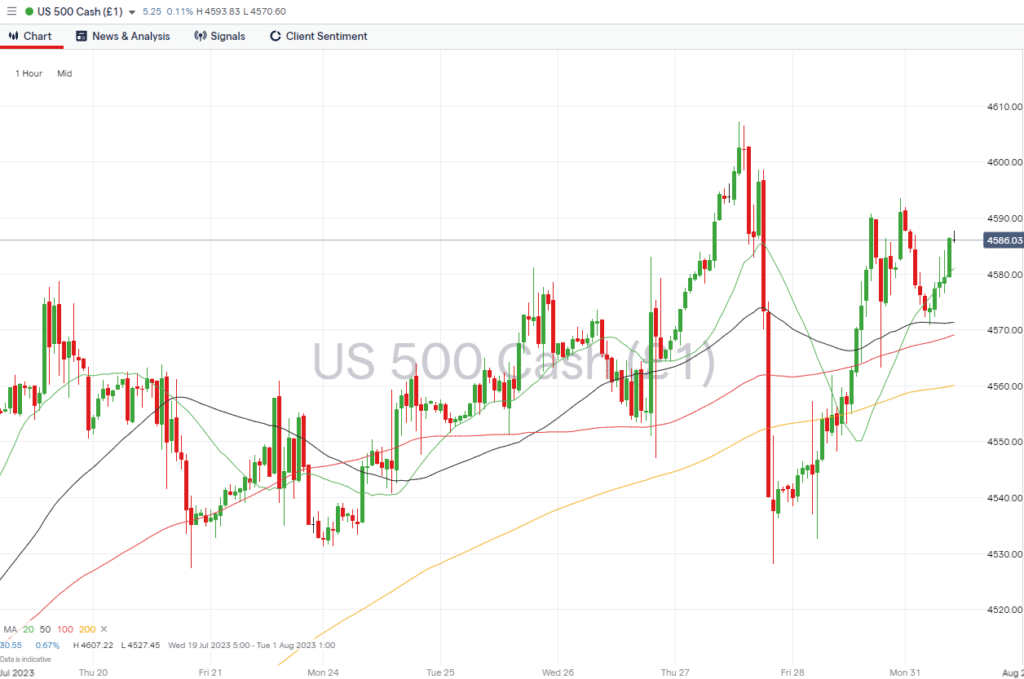

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Tuesday 1st August – 3:00pm BST – US PMI manufacturing PMI. Manufacturing PMI is expected to fall to 46 and services to weaken to 54.

- Thursday 3rd August – 3:00pm BST – US ISM Services PMI. Index expected to fall to 52 from 53.9.

- Friday 4th August – 1:30pm BST – US Non-Farm Payrolls (July). Payrolls expected to rise 190,000 from 209,000 in June, and unemployment levels to remain unchanged at 3.6%

Companies releasing earnings reports this week:

- Tuesday 1st August – PayPal, Caterpillar, AMD, Starbucks, Uber.

- Wednesday 2nd August – Kraft-Heinz

- Thursday 3rd August – Apple, Amazon, Coinbase, Airbnb, ConocoPhillips, GoPro.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.07.31

- The Best and Worst Performing Currency Pairs in June 2023

- The Week Ahead – 24th July 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk