- The Fed holds US interest rates steady in a move dubbed a “hawkish pause.”

- The guidance released after the rate announcement reveals Fed officers expect rates to remain higher for longer.

- Eurodollar’s rally into this week’s central bank announcements could be about to unwind.

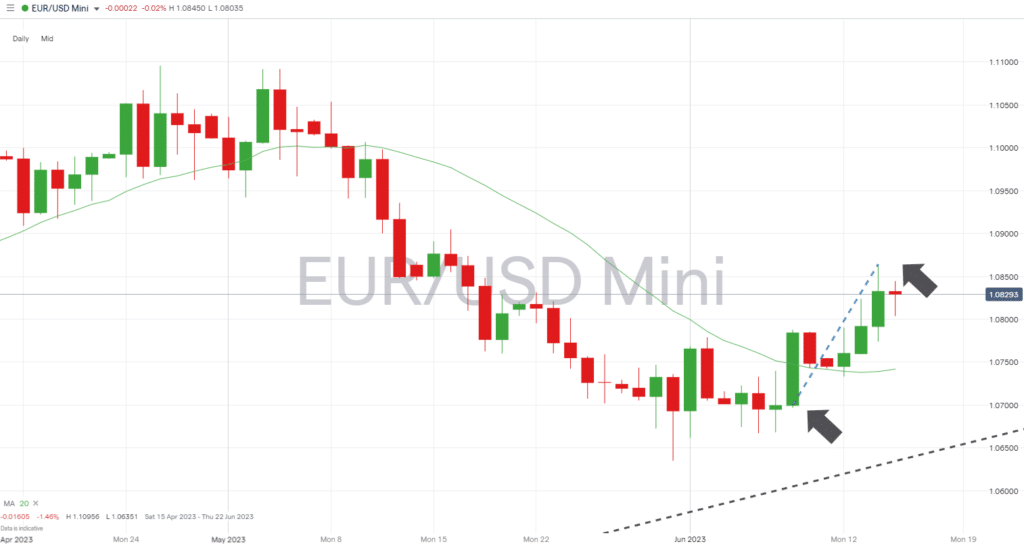

The long EURUSD trade idea identified last week has started as well as could have been hoped, but the ‘hawkish pause’ declared by the Fed on Wednesday raises the question of whether to lock in some profits or continue running the position. Within one week, analysts have shifted to view the Fed as adopting a more hawkish stance and a more dovish one by the ECB.

The EURUSD price move from the market open on Thursday 18th to the close on Wednesday 14th was from 1.06994 to 1.08325. That’s a pleasant return on the long EURUSD strategy, which was an attractive proposal, more for having relatively tight stop-loss levels, than offering certainty regarding which direction price might have moved. As the Fed and ECB kept a relatively low profile in the run-up to their respective interest rate announcements, the technical indicators which identified the possibility of a price surge had time to come into play.

EURUSD Daily Price Chart 2023 – Bear Market Retracement?

Source: IG

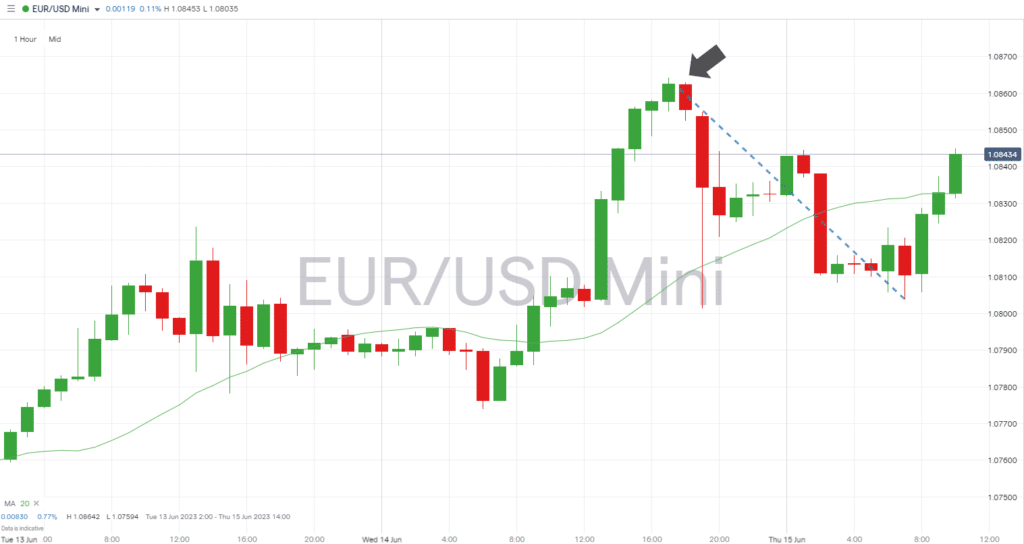

Immediately after Jerome Powell announced he and his colleagues had decided to hold interest rates where they were, the euro slid in value against the greenback. As the EURUSD currency pair could have been expected to rise due to further ECB rate hikes in the pipeline, there is a need to understand the counterintuitive move.

EURUSD Hourly Price Chart 14th June 2023 – Immediate Response to Fed

Source: IG

The possibly surprising reaction to the Fed holding rates steady can be explained by the commentary which followed the announcement, pointing to June’s decision being a ‘hawkish pause’ rather than a change in direction. Fed Chair, Jerome Powell, explained the break as a chance to reflect, saying:

“We have raised our policy interest rate by five percentage points, and we’ve continued to reduce our security holdings at a brisk pace. We’ve covered a lot of ground and the full effects of our tightening have yet to be felt.”

But analysts were more interested in the ‘dot-plot’, which details where each member of the FOMC stands on future policy. After June’s FOMC meeting, the individual dots of each member’s prediction have moved decidedly upward. The median expectation of interest rate levels, as projected by the people who set them, is now 5.6% by the end of 2023.

For that level to be reached, there would need to be a 50-basis point rise in interest rates, and there are only four FOMC meetings before the end of the year. Traders have immediately pointed to the likelihood of a 25-basis point rise in July and September. Still, whichever month those hikes come in, the idea that the doves were gaining hold of policy has been put on hold for now.

People also Read:

- The Case for Buying EURUSD Ahead of Next Week’s Interest Rate Decisions

- The Week Ahead – 12th June 2023

- WEEKLY FOREX TRADING TIPS – 2023.06.12

- The Best and Worst Performing Currency Pairs in May 2023

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk