FOCUS ON: US Federal Debt-Ceiling and Risk of Default

- A quiet week in terms of core economic data

- US debt-ceiling debate likely to dominate financial market sentiment

- Some analysts predict 1st June could be the day the government runs out of money

The risk that the US government would not have sufficient funds to meet its day-to-day obligations is increasing. A stand-off between political parties in Washington has left both sides unable to agree on a deal. Some analysts suggest that 1st June could be the day that social security payments, pensions, and government salaries aren’t paid.

A failure to reach an agreement could also result in the US defaulting on payments to bondholders and a major shakedown of the financial markets. If common ground is found, then last week’s broadly positive news announcements can be expected to cause a continued move into risk-on assets.

Forex

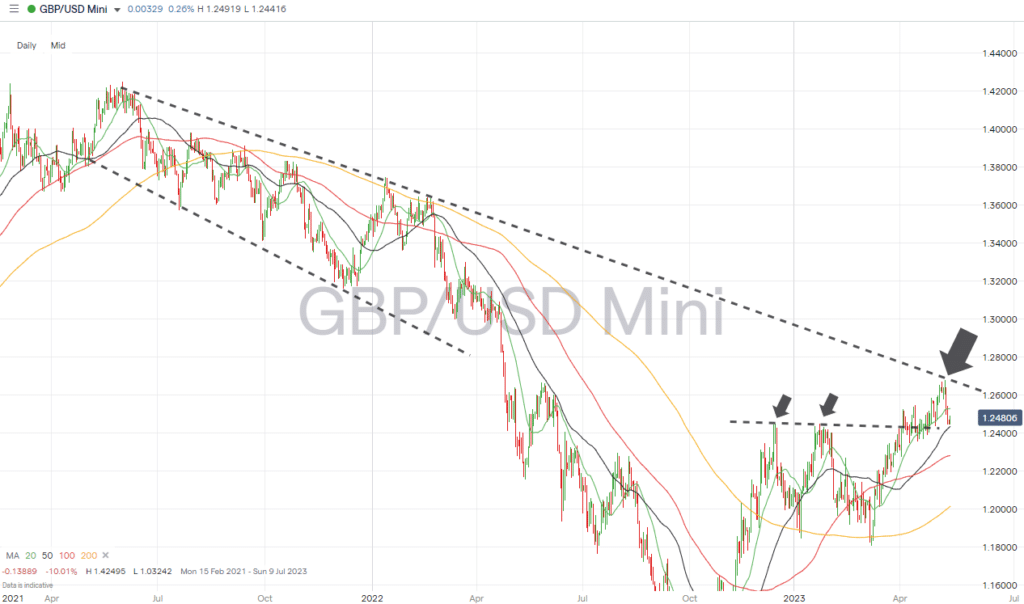

GBPUSD

After the Bank of England raised interest rates by 25 basis points last week, all eyes now turn to the UK unemployment report due Tuesday, 16th May. That jobs report will offer insight into the health of the UK economy and allow analysts to gauge the appetite the Bank has for further rate hikes.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

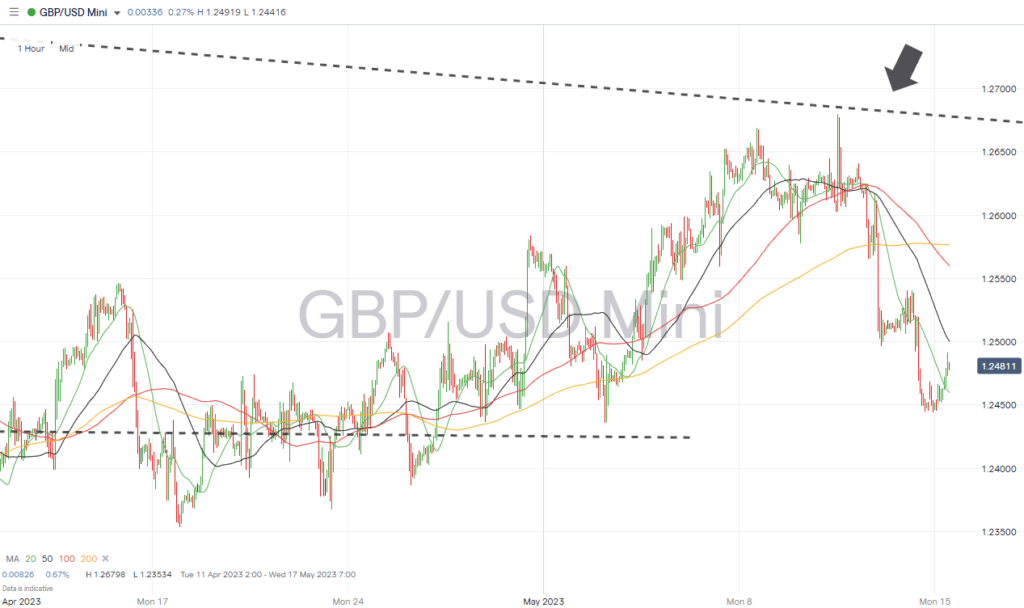

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic data:

- Tuesday 16th May – 7 am GMT – UK employment data: Analysts expect the April claimant count to fall by 15,000, while the March unemployment rate remains constant at 3.8%.

UK earnings reports:

- Tuesday 16th May – Land Securities, Vodafone, BooHoo, Imperial Brands, Britvic, Greggs.

- Wednesday 17th May – British Land, Sage.

- Thursday 18th May – National Grid, Premier Foods, Burberry, BT, easyJet.

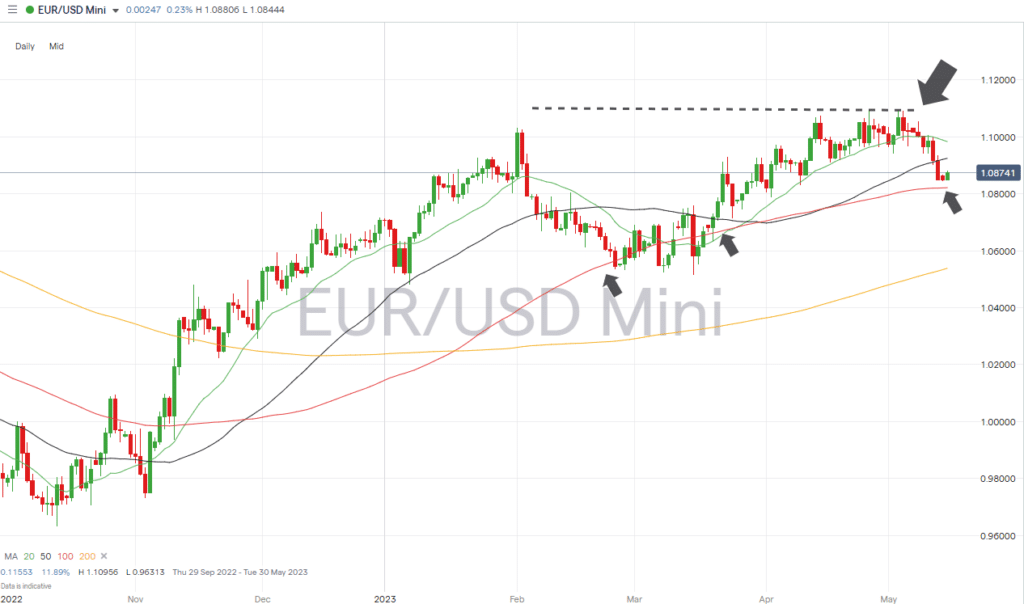

EURUSD

With little Eurozone-specific data due to be released, Eurodollar traders will focus on the US side of the currency pair. That will involve studying the negotiations between the political parties in Washington as they try to agree on how the problem of the Federal debt ceiling will be tackled.

EURUSD Chart – Daily Price Chart

Source: IG

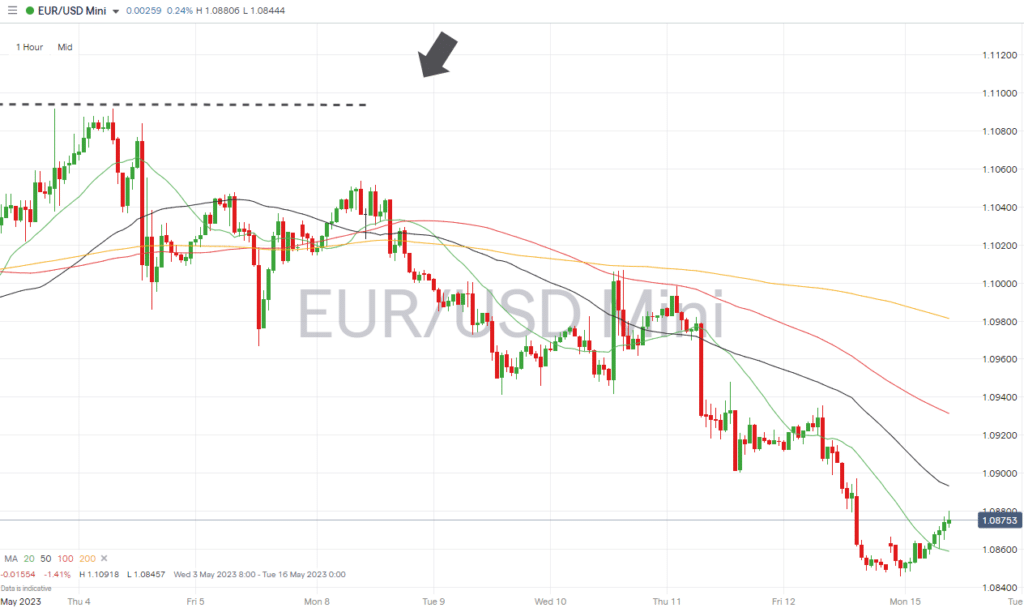

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Tuesday 15th May – 10 am GMT – German ZEW index (May): Analysts forecast the ZEW index to rise to 7 from 4.1.

Indices

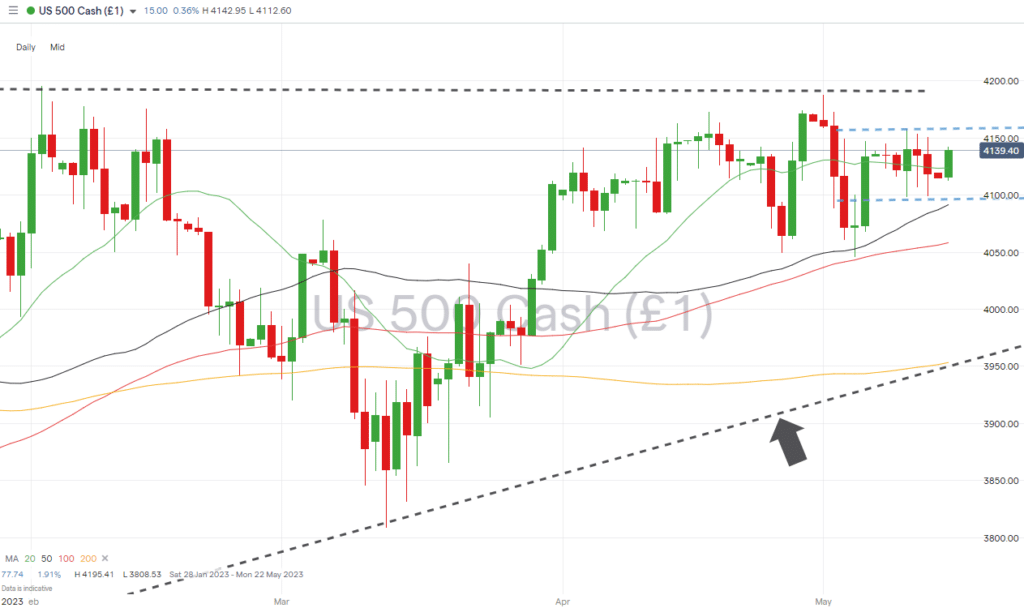

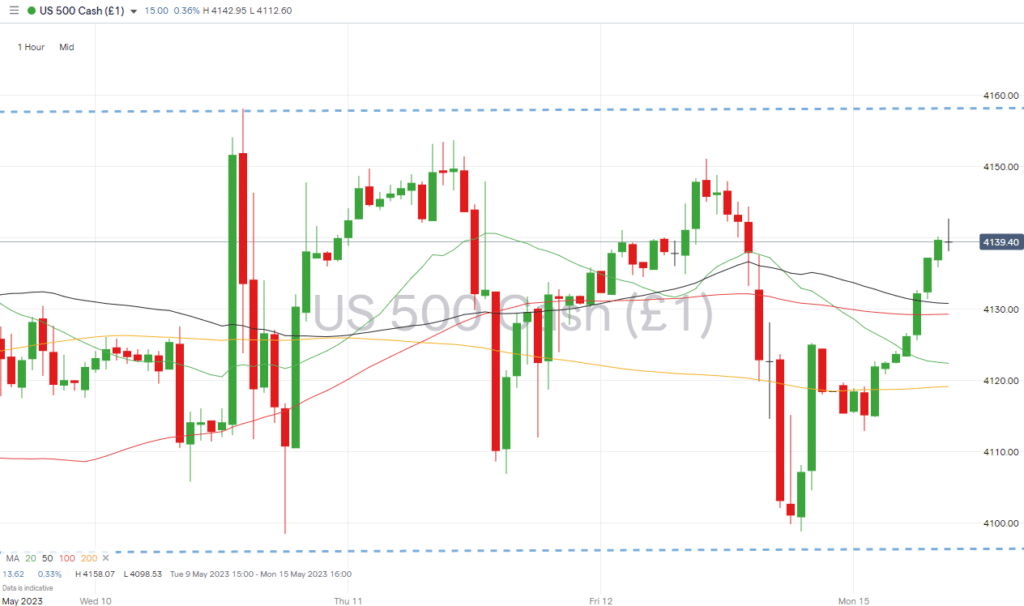

S&P 500

It is the turn for retailers to update investors as we enter the tail-end of earnings season. Walmart’s announcement on Thursday is the big data point for US investors, who will also have one eye on how the Federal debt ceiling negotiations are progressing.

S&P 500 Chart – Daily Price Chart – Ascending Wedge Pattern

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Tuesday 16th May – 1.30 pm GMT – Analysts forecast US retail sales (April) to rise by 0.7%

US earnings reports:

- Tuesday 16th May – Home Depot

- Wednesday 17th May – Cisco

- Thursday 18th May – Walmart

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.05.15

- How Much Higher Can Sterling Go?

- The Best and Worst Performing Currency Pairs in April 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk