FOCUS ON: Risk Appetite Continues to Build and Takes Prices to Region of Key Resistance Levels.

- US Q4 GDP numbers dominate the economic calendar

- Report due to be released at 1.30 pm (GMT) on Thursday 26th January

- Forex and stock markets await critical data release

Risk-on assets such as GBPUSD, EURUSD, and the S&P 500 index have made a promising start to 2023; however, the Q4 GDP report due out of the US on Thursday could send markets in either direction. The report will offer a detailed breakdown of the state of the US economy and an insight into how the Fed’s hawkish interest rate policy is impacting producers and consumers.

With the next batch of Non-Farm Payroll and US inflation data not due for several weeks, investors will also be assessing the quarterly earnings releases by big corporations, including Tesla.

Forex

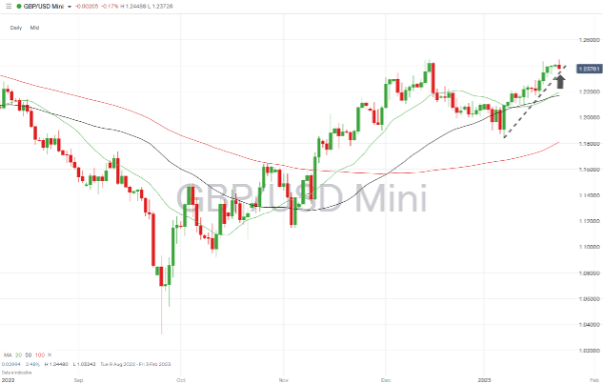

GBPUSD

UK Manufacturing and Services PMI for January is released on Tuesday 24th January. Analysts forecast that the manufacturing index will rise to 46, and the services number will creep over the crucial 50 level and come in at 50.1.

Currency markets and sterling could also be influenced by the trading updates and quarterly results offered by the London-listed firms. Saga Ltd and Associated British Foods report on Tuesday 24th January. EasyJet, Tullow Oil and JD Wetherspoons update the markets on Wednesday 25th January, and Fevertree, Britvic, Dr Marten’s, Mitie and Tate & Lyle all report on Thursday.

GBPUSD Chart – Daily Price Chart

Source: IG

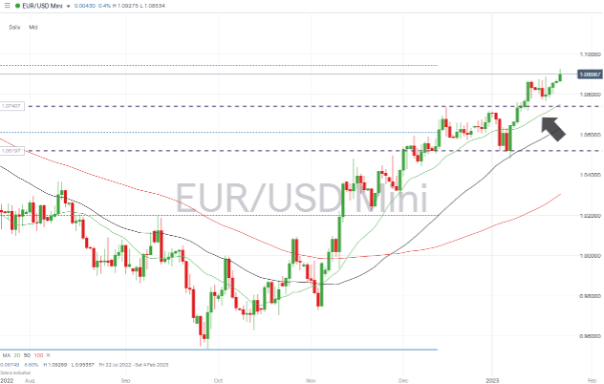

EURUSD

Eurozone, consumer confidence numbers, kick the week off for traders of EURUSD and other euro crosses. That report is due at 3 pm (GMT) on Monday 23rd January. On Wednesday, the German IFO Business Climate report is updated at 9 am (GMT), with analysts forecasting the index will rise to 90.2.

Sandwiched between those releases are a range of important data points. Tuesday 24th January will reveal the German Gfk Consumer Confidence report for February and Germany’s and the eurozone’s Manufacturing and Services PMI (flash) numbers for January.

EURUSD Chart – Daily Price Chart – Price Channel Break

Source: IG

Indices

S&P 500

Earnings season has so far thrown up a few surprises, including the exit of the Netflix CEO and job cuts at Google’s parent company Alphabet. Stock markets have so far managed to shrug off these bouts of bad news, but earnings season hots up this week with the bellwether stock Tesla releasing its report on Wednesday 25th January.

S&P 500 Chart – Daily Price Chart – Approaching Trendline Resistance

Source: IG

Corporate earnings releases due the week beginning 23rd January include:

- Tuesday 24th: Microsoft, Verizon, General Electric, and Johnson & Johnson.

- Wednesday 22nd: Tesla, Boeing, ASML, IBM, and AT&T.

- Thursday 23rd: Visa, Dow, Intel, and American Airlines.

- Friday 24th: Chevron Corp and American Express.

People Also Read

- US Inflation Cools in December

- The Week Ahead – 16th January 2023

- Cooling US Inflation – Is it Time to Short the Dollar?

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk