In the modern trading arena, with cutting-edge technology and instantaneous communications at everyone’s fingertips, prices of commodities, stocks, and currencies zigzag, sometimes significantly and fast. In addition, of course, price instability severely impacts trading decisions. Thus, traders must get to grips with the forces driving price fluctuations like central bank actions, wars, politics, sudden inflation, extreme weather, natural disasters, and short-term ‘unexpected’ events.

More specifically, currency price volatility revolves around embracing two fundamentals in the trading system:

- Always only two currencies (i.e., a pair) showing the relative value of one versus the other.

- An average price (i.e., the mean) for every pair over a trading cycle (e.g., a year, month, day, hour).

Thus, observing how far prices move from the mean determines the volatility level or degree of deviation.

Volatility creates openings for astute traders or headaches for those without the resources to anticipate or cope with it. So, rapid/broad movement generally stamps the pairing as highly volatile, and vice versa for infrequent/tight movement situations. In other words, one can be sure that the higher the volatility, the more substantial the loss if you get it wrong or the reward for assessing things accurately.

The problem is this – accuracy requirements are a tall order in a volatile environment, so instead, the line of least resistance is to trade the currency pairs reflecting the least volatility.

Measuring Volatility

Assume we want to trade the Australian Dollar (AUD) paired with the US Dollar (USD). Typically, it will appear as AUD/USD with the currency on the left of the / mark (i.e., AUD) expressed in terms of the one on the right (i.e., USD). So, if the AUD/USD = $0.72, it means that one Australian dollar = 72 US cents. Of course, you can see it from the USD/AUD angle as one US dollar swaps for 1.38 Australian dollars.

As such, the following can be considered:

- One hundred (100) basis points (i.e., 1%) or higher = “High Volatility.”,

- Zero to ninety-nine (99) basis points = “Low Volatility.”

Assuming the AUD/USD average price is 72 cents, if daily volatility forces move the needle higher than 727c or lower than 713c, we would consider it highly volatile.

Finding the Least Volatile Forex Pairs

No country is immune from volatility spikes from time to time, contrary to standard expectations. Moreover, it takes only one currency in a pairing to create high volatility. A case in point is the UK’s currency GBP, interacting with recent political turmoil on top of Brexit. Thus, the USD/GDP pairing moves more than 100 points daily; and GDP likewise against other relatively more stable currencies. It emphasises why traders must keep a close eye on short-term events that can significantly impact even the most stable currencies in our midst.

The Least Volatile Major Forex Pairs

One need look no further than the USA, Canada, Switzerland, Australia, Japan, and the European Union (the latter containing high-ranking countries like Germany and The Netherlands) when seeking prime examples of:

- Citizen prosperity

- Economic and political stability

- Trade freedom

- Financial policy leadership

However, overall stature is one of two signature Main Pair characteristics. The other is that the USD must be one of the currencies.

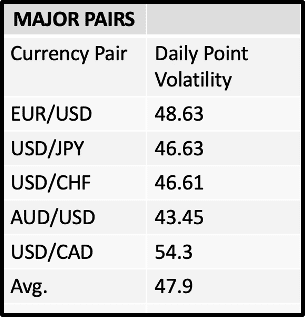

Consider the following table:

Source: FXSSI

It’s not surprising that in 2022 the ‘least volatile currency pairs’ are AUD/USD (mentioned in our introduction), although it’s a close contest. It’s followed closely by USD/CHF (Swiss Franc), USD/JPY (Japanese Yen), EUR/USD (The Euro), and USD/CAD (Canadian Dollar) anchoring the group.

The countries mentioned have carved out reputations based on:

- Banking/financial powerhouse foundations through centuries-old neutrality (i.e., Switzerland).

- Global trade initiation via North American alliances (i.e., Canada and the US).

- Combining twenty-seven member states on one continent (i.e., the European Union).

- Regionally stabilising an otherwise politically volatile global sector (i.e., Japan and Australia).

The Least Volatile Minor Forex Pairs

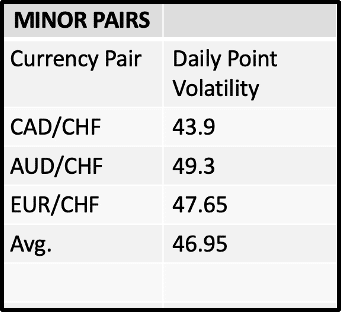

Minor currency pairs, frequently referred to as cross-currency pairs, always exclude the USD but typically include any of the others mentioned above as pairs or with GBP and NZD (the New Zealand Dollar). The least volatile in this category during 2022 were as follows:

Source: FXSSI

The Least Volatile Exotic Forex Pairs

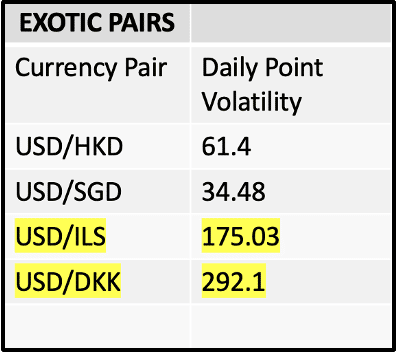

USD must participate in every pairing under this category, but a slew of currencies not mentioned above enter the picture. When the term ‘exotic’ appears, all kinds of images work their way into the mix. However, the deciding influence in all cases is poor liquidity. The latter is the primary energiser of massive swings around the mean. It doesn’t take much for a few active traders to manipulate the markets, creating bull and bear traps that can drive the less sophisticated into the trading wilderness, never to return.

Thus, detecting low volatility under this heading is challenging, but we did find two. Hong Kong (HKD – the Hong Kong Dollar) and Singapore (SGD – The Singapore Dollar) are respected trading hubs with disciplined financial oversight. They may be small geographically, but their reach internationally is impressive. Nations trading with both countries have confidence in their integrity and capability to compete with the best industrial centres. After that, it goes wildly above 100, so we listed the next two to illustrate the narrow window of low volatility.

Surprisingly, Israel (ILS = Israeli New Shekel) doesn’t align with them, and it’s perhaps a function of middle east tensions that are always close to them. As for Denmark (DKK = Danish Krone): it’s been in the European Union since 1973 but opted to exclude the Euro in favour of the Danish Krone. However, it appears to be a miscalculation because the latter’s volatility in a pairing with the USD doesn’t come close to matching the Euro’s stature or stability. See the table below:

Source: FXSSI

How to Trade Forex Pairs With Low Volatility

It’s vital to understand that volatility is a relative term. Traders shouldn’t deceive themselves that they’re unlikely to emerge as massive losers by trading a low-volatility pair. A 50-point level of volatility or less can wipe out your bankroll in a blink, depending on how many trades you make in a day and how far you chase the deficit in the hope of recovery. Therefore, traders should safeguard every position with a stop loss. Moreover, we advise only trading highly liquid markets to enter trades with the confidence that the stop loss protections will do their jobs. In markets with low liquidity, a ‘trade-gone-wrong’ can go worse and travel through the stop loss without closing out. Finally, trade:

- Within your budget

- On a time scale agenda that you feel comfortable with

- Approach the challenge without emotion so that lost causes don’t bankrupt you. Lucky enough for traders, the highly liquid pairings are simultaneously the least volatile and vice versa.

The Best Forex Brokers

Consult our list of the best forex brokers – each one trusted reviewed and regulated to ensure a safe and seamless trading experience:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

The primary takeaway for currency traders is to zone in on low-volatility currency pairings with unsurpassed liquidity and apply stop-loss tactics to curtail possible losses. In this article, daily volatility was our yardstick. However, you may want to trade on hourly, weekly, monthly, or longer cycles, bringing different means and basis point deviations into your volatility calculation. We suggest you connect with a reputable forex broker to help guide your trading activities and provide professional advice on all crucial aspects.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.