Although we see risk of a corrective consolidation lower for both the New Zealand and Australian Dollars, we still see an underlying positive tone for these currencies versus the US Dollar into October.

For NZDUSD, the strong base has been reinforced through mid-month to signal upside risks, whilst for AUDUSD we see a positive bias within a broader range, with bias for a bullish switch.

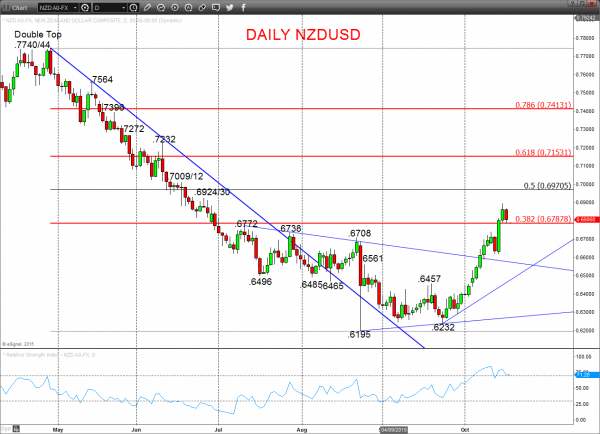

NZDUSD

An early October rally through key .6561 resistance, then through .6708, .6738, .6772 and .6788 targets has reinforced bullish tone for October.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a bullish threat to .6924/30.

- Above here targets .7000/09/12 and .7232.

What Changes This? Below .6473 signals a neutral tone, only shifting negative below .6232.

Daily NZDUSD Chart

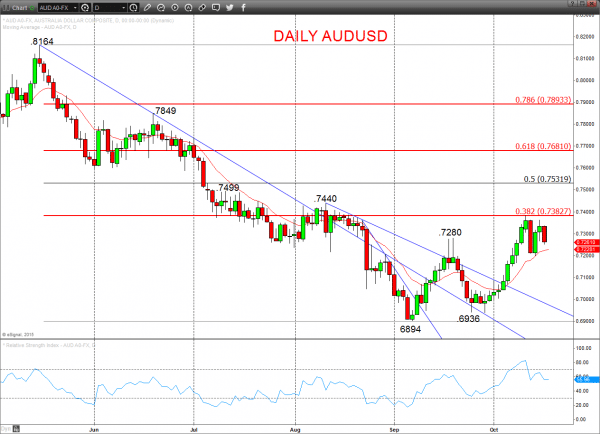

AUDUSD

A setback Friday reinforces a range theme for October after the push above .7275/80 (September shooting star candlestick highs).

But we still see the skewed risk for the balance of the month for a bullish breakout above .7440.

Short/ Intermediate-term Range Parameters: We see the range defined by .6936 and .7440.

Range Breakout Challenge

- Upside: Above .7440 aims higher for .7499 and .7681.

- Downside: Below .6936 sees risk lower for 6894, .6857 and .6645.

Daily AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.