To taper or not to taper, that is the question? A funny thing happened on the way to the forum or, perhaps, it was on the way to Jackson Hole, but the markets chose to ignore the elephant in the room once more and establish new All-Time Highs (ATHs) as if all was right with the world. After a brief shudder, pundits suddenly realised that Fed Chairman Powell might say a few words on Friday at the big confab in Wyoming that could impact the markets. What, me worry?

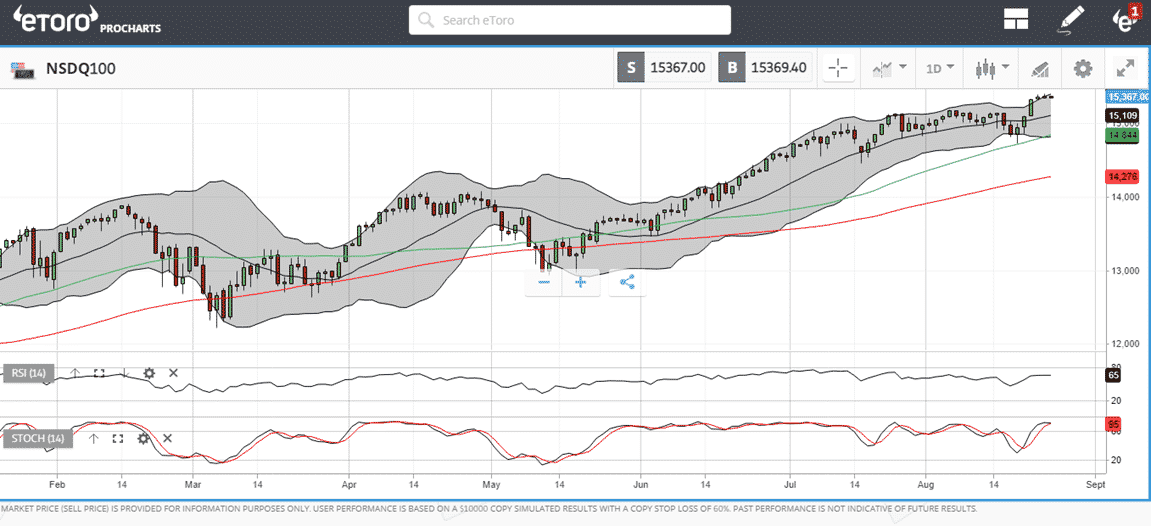

After the Fed minutes were analysed last week, markets bumped, gyrated, almost corrected, but soon came roaring back to life. The US Dollar was supposed to strengthen. The euro was supposed to slide down a slippery slope, and stocks were to sell off as the big red “Risk Off” button sounded its nefarious alarm. These worrisome prognostications made for great headlines in the financial news, as the usual talking heads lamented the current state of affairs. But this week did not follow the plan. The dollar weakened. The euro strengthened, and the S&P 500 and the NASDAQ 100, lo and behold, set new record ATHs.

Source: eToro

And then someone checked the economic calendar. The Fed is scheduled to hold its annual economic symposium at the end of this week in the pleasant locale of Jackson Hole, Wyoming, and none other than Jerome Powell is on the docket to say a few cogent words.

What will Powell say? Will he announce more clues as to when and by how much he and his merry band of bankers’ plan to taper the Fed’s monthly buyback of securities, viewed by many as the stimulus that is keeping market values floating on thin air?

Markets seemed to breathe a sigh of relief this week, sensing that Powell might not muddy the waters. Can the market go higher? Why was there a rebound? Will Powell announce a tapering schedule surprise? Here are a few comments from those who should know:

- Patrick O’Hare, market analyst with Briefing.co: “What can’t be overlooked, however, is that there still isn’t any concerted selling interest.”

- Analysts from Charles Schwab investment bank: “The rebound for stocks has come amid cooling concerns about the global spread of the Delta variant, as data suggests cases may be peaking and as the (US Food and Drug Administration) fully approved a coronavirus vaccine this week.”

- David Carter, chief investment officer at Lenox Wealth Advisors in New York: “Following a long run, equity indexes have cooled off as the next engine of growth is unclear. (The) expectation is that Fed won’t scare markets and will announce only a cautious tapering.”

Concluding Remarks

All eyes and ears will be focused on the tiny hamlet of Jackson Hole on Friday. Conventional wisdom says Powell will taper his comments about tapering, but the market may have hit its peak. Reuters’ recent poll of analysts concludes that the S&P 500 may be range-bound for the remainder of 2021. Perhaps, it’s time to schedule a holiday in Wyoming.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk