No matter how well the stock market is doing, there will always be a naysayer or two who claim that a crash is imminent, typically accompanied by a sales pitch on how to protect your portfolio when the sky falls. Current stock market values are indeed elevated, and once again the doom-and-gloomers are beginning to hype that a correction is coming. Such sensationalism is usually a poor attempt to attract readers to a website – modern-day ‘click bait’, if you will – but the presence of such talk has been increasing of late. Is there any truth to these notions?

Source: Multpl.com

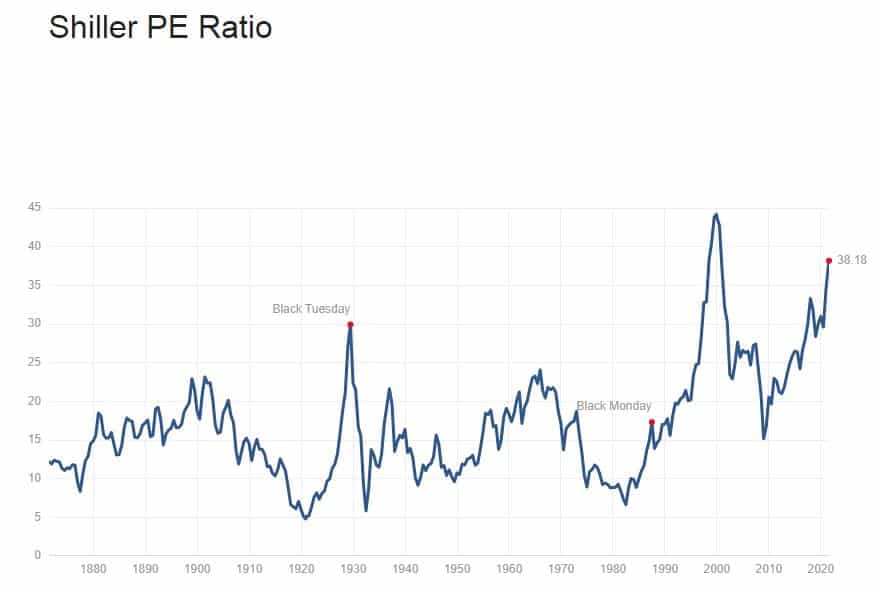

These purveyors of apocalypse are quick to trundle out the infamous Shiller CAPE Index chart, a plotting that gained favour years back for illustrating that market valuations had climbed too high. The methodology plots what is deemed a cyclically adjusted price-to-earnings ratio (CAPE), a formula that compares price to a 10-year moving average of earnings, adjusted for inflation. The result can be intimidating. Black Tuesday, Black Monday, and the dot-com crash are obvious peaks, which were followed by, wait for it, a massive correction. Today’s value is at a peak.

Aside from the folks trying to make names for themselves or sell their wares, a few of the latest prognosticators of doom have appeared on such respected portals as Forbes, the Motley Fool, and CNBC. Concerns raised have to do with China, inflation and COVID-19 Delta variant surges. Barry Knapp, director of research for Ironsides Macroeconomics, noted: “I’m in the camp where I think we’re going to have our first major correction. What we’re likely to get is at least 10% or more. … It could really happen when they [Fed officials] make the announcement in September.”

What will this week bring to the debate table?

Earnings season will get into full swing this week, as a full quarter of S&P 500 participants will issue reports. Sonal Desai, chief investment officer for Franklin Templeton, observed: “I think as much as 85% of the companies which are reporting earnings mentioned inflation on their earnings calls.” The Fed may think that inflation is temporary, but Friday’s Non-Farm Payroll report could be a “game changer”, according to Knapp.

Net new jobs in June were 850,000, but July expectations are for a slight decline to 788,000 and a small drop in unemployment. Wage inflation forecasts tap 3.9% a year. If figures are weak, Chairman Jerome Powell claims that he would continue buyback stimulus programmes unabated. If too strong, the Fed could threaten to cut stimulus and speed up planned interest rate hikes. Markets would likely fall in the latter scenario, or as Knapp opined: “Bad is good. Good is bad.”

Concluding remarks

Eventually, all stock markets decline. Share prices fall. Until such a correction takes place, caution is advised, and your best course of action may be to sit tight and ride out the storm. The problem occurs when an investor panics and sells during a downdraft. Markets always improve after corrections, a statement of fact. Conserve your cash and wait for the buying opportunities that will certainly arise.

Sources:

- https://www.forbes.com/sites/johntobey/2021/07/10/opportunity-ahead-a-week-of-negatives-increases-probability-of-stock-market-correction/?sh=74ea18202f4f

- https://www.fool.com/investing/2021/08/01/3-reasons-not-to-worry-about-a-stock-market-crash/

- https://www.cnbc.com/2021/07/30/july-jobs-report-could-be-what-gives-the-market-its-next-big-jolt-in-the-week-ahead.html

- https://www.financialexpress.com/investing-abroad/featured-stories/foundation-of-us-stock-markets-fragile-says-morgan-stanley-broader-market-correction-may-be-coming/2291886/

- https://macrodata.io/shiller-pe-ratio.php

- https://www.multpl.com/shiller-pe

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk