For the first time in a month, the euro peaked above 1.19, as the pair rose on promising economic news in Europe. Economic activity in the Eurozone grew in the second quarter by 2.0%, a full 0.5% better than expectations. Inflation data was also encouraging, printing a 2.2% annual growth figure when a similar measure in June had come in at 1.9%.

Source: eToro

If you remember learning about sine waves way back in academia, then the daily EUR/USD chart depicted above for the past 10 months could easily have been used as an example. The shape is emblematic of how the worldview has been stunted by the COVID-19 pandemic. As each wave has made its way around the globe, hope has often been dashed by a sudden resurgence or unexpected outbreak. Developed economies have added stimulus, as central banks have kept the printing presses running at uncoordinated intervals – another reason for this pricing behaviour.

Will the euro continue to strengthen?

If the euro keeps this steady repeating beat going, then the obvious play would be to go long, though the message from the stochastics indicator would seem to augur otherwise. On the other hand, the euro has broken out of a falling channel formation, thereby suggesting that a rise to 1.20 is on the cards. The only caveat is that it creased the upper limit of the Bollinger Bands, an event that has not occurred since last May. During its last run-up, however, the EUR/USD pair hugged the upper band for nearly two months before descending.

It also needs to be noted that recent weakening in the US dollar has benefited the euro. US Fed watchers are currently parsing Chairman Jerome Powell’s latest missive for insights for the road ahead. The market had expected news related to tapering of monthly security purchases in the open market, a mild form of stimulus, but Powell is taking a ‘wait-and-see’ posture. He feels that inflation bumps are temporary and do not justify a change in the Fed’s current tapering plans. The consensus opinion is that such a dovish stance can only keep the USD in check while also helping the euro’s prospects.

What is the best way to trade this current situation?

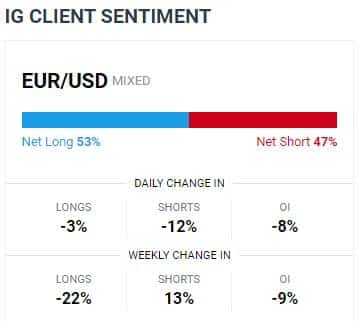

The general thinking at this stage is that the euro has enough momentum to push higher, despite any short-term technical hurdles in its way. Trader sentiment, however, is starting to shift in the opposite direction, as per this pictorial from IG:

Longs appear to be running for the hills, though the pace seems to be slowing to 3% per day from a weekly figure of 22%. Astute traders tend to be contrarians under these circumstances where the tides are beginning to turn. The herd is slower to react in mass, so to speak. It may be too early to close any long positions, but watch the market closely.

Concluding remarks

The EUR/USD reversed its downward trend with four positive trading sessions during last week. Will this reversal continue in the week to follow? The market could range before Friday’s Non-Farm Payroll release, but short-term momentum might still be the ticket beforehand.

Sources:

- https://www.dailyfx.com/forex/market_alert/2021/07/30/EURUSD-Pops-Above-1.1900-on-Better-Than-Expected-Euro-Zone-GDP-Data-.html

- https://www.dailyfx.com/forex/analyst_picks/todays_picks/rich_dvorak/2021/07/29/euro-forecast-eur-usd-breakout-eyes-key-1.2000-price-level.html

- https://www.dailyfx.com/forex/market_alert/2021/07/29/us-dollar-hits-monthly-low-as-jobless-claims-q2-gdp-disappoint.html

- https://www.fxempire.com/forecasts/article/eur-usd-weekly-price-forecast-euro-wipes-out-significant-losses-760227

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk