After several days of roller coasting, the financial markets took a breather on Wednesday and offered an opportunity for investors to consider which way next? Interestingly the forex and equity markets appear to be drawing different conclusions, and the disconnect, and the potential for one of them to realign, could point to more volatility soon.

Stocks After the Fed’s Interest Rate News

Stocks were a mixed bag, with flagship indices posting a collection of positive and negative daily returns on Wednesday. One noteworthy feature is that the market darlings, the Nasdaq 100 and Russell 2000, were the ones that posted up-days while mainstream indices, DJIA, S&P 500 and FTSE 100, were down on the day. There is still some investor appetite for equities at these levels, but not all equities, which is in itself a sign that the market is beginning to lose momentum.

Wednesday’s index moves

S&P 500 4,241 -0.11%

Nasdaq 14,271 +0.13%

Russell 2000 2,303 +0.33%

Dow Jones 33,874 -0.21%

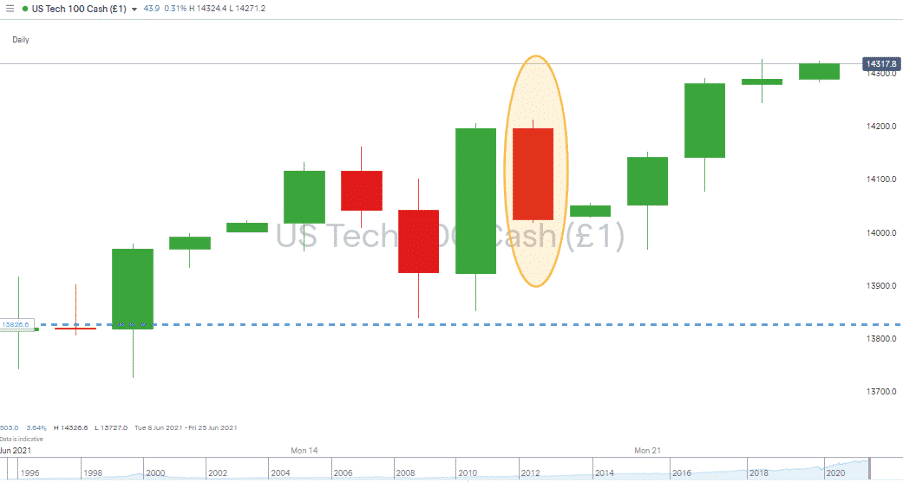

The Nasdaq has rebounded to post new all-time highs. Investors in tech stocks are putting faith in the sector somehow being less exposed to inflationary and interest rate pressures.

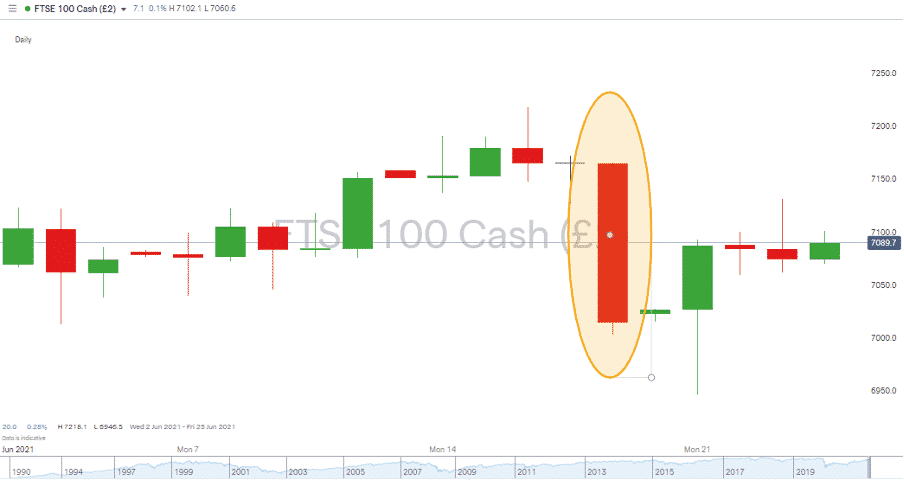

The FTSE 100, in comparison, has failed to regain all the ground it lost to the announcement from the Fed and continues to polish its reputation for being one of the most “undervalued” global indices.

Source: IG

Forex After the Fed’s Interest Rate News

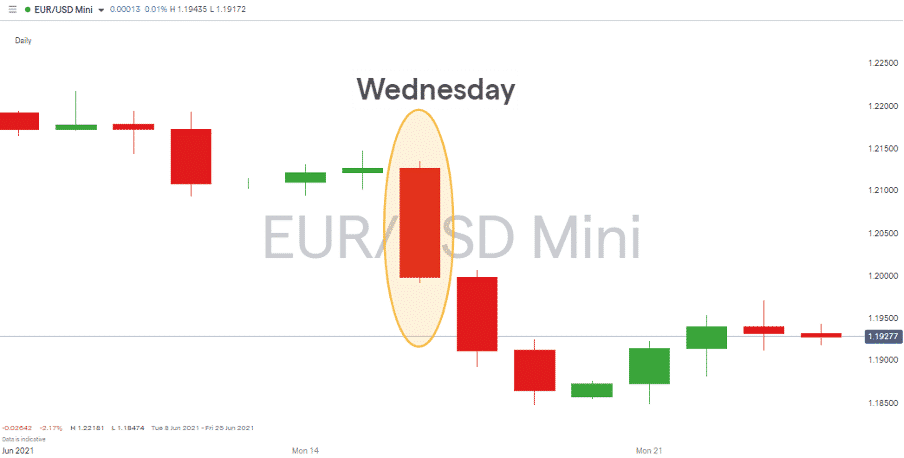

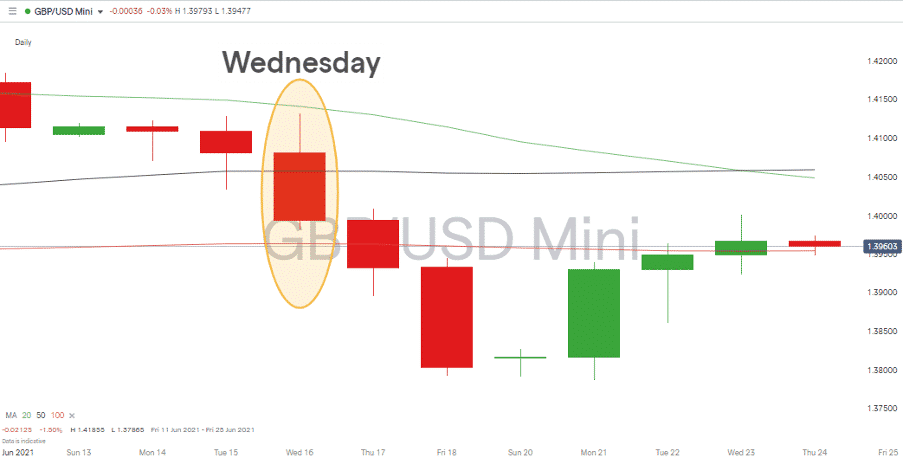

The reaction of the forex markets to news that global interest rates are heading north has been more textbook in nature. EURUSD and GBPUSD both had an immediate response to the US Federal Reserve’s update of last Wednesday. Their downward moves had greater urgency than the equity markets, which were in denial until Friday.

Source: IG

Source: IG

Forex prices have consolidated at the lower levels rather than rebounding in line with equities, representing an interesting disconnect between the two markets. Risk currencies such as GBP and EUR have, for now, at least lost ground to the US Dollar, and the USD Basket index could be the key to whether the traders on the forex desks or equity desks have made the right call.

Source: IG

The daily price chart for USD Basket suggests there could be a double-bottom pattern forming at the 8947 level. That price range marks the current low and that of June 2021. Taking the date range back to January 2018, there is a low in the same area, 8800, and a multi-month period of testing the 8947 support/resistance level, which now looks like a crucial indicator.

With the dollar basket trading at 9175 on Thursday, the 8947 represents considerable support. A break above the April high of 9342 would confirm a breakout of the double-bottom and be extra bullish due to the side order of a possible triple bottom dating back to 2018. There will come the point when we find out if the party really is over as the forex desks are suggesting or if equity bulls will be able just to turn up the volume and carry on again.

If you want to know more about this topic, please contact us at [email protected].

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk