The US Federal Reserve’s interest rate announcement on Wednesday is the big event of the week. It raises the question of which forex pairs to hold going into what should be a significant event.

The view from the trading floor is that, of course, the Fed won’t increase interest rates, and of course, it won’t budge from the current position. Despite this certainty, the feeling is that there may be signs of when a policy change might come about. If the Fed even begins talking about a more hawkish monetary policy, there could be significant price moves.

The obvious beneficiary of higher US interest rates would be the US dollar itself. All currencies benefit from any shift, which means they supply a better return for holders.

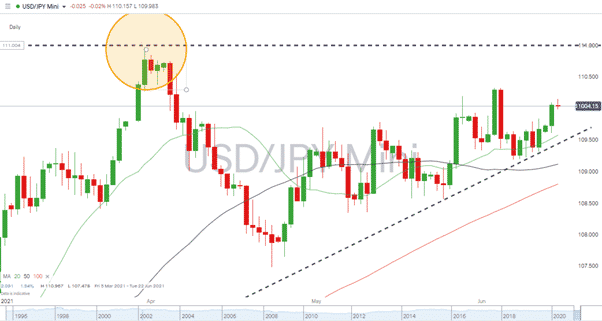

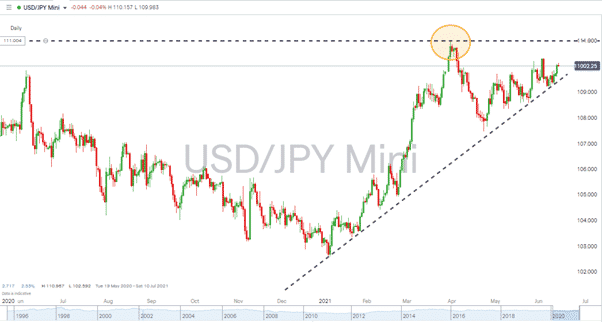

The Case for Holding USDJPY into the Interest Rate Announcement

The slow-burner of major forex pairs might not offer the short-term volatility of other pairs, but the long-haul momentum patterns of dollar-yen certainly has fans.

Source: IG

Since January, the greenback has shown strength against the Japanese yen. Currently, up approximately 7% on the year, the dollar has been helped by predictions that US rates will rise before Japan’s. The US economy may well have cold-spots in its economy, but in general, it’s rebounding faster from the global lockdown than perma-deflated Japan.

The supporting trend-line is typical for moves in the pair, and the US Fed’s mood music is doing little to suggest that line will soon be broken. The spike in April to 110.00 was a relatively aggressive price surge for the currency pair, and 111.00 is a major resistance level, so in hindsight, a pullback was not surprising. The hold above the trend line was crucial, and unless the Fed surprises everyone, a retest of 111.00 appears the likely option. How that rising wedge pattern pans out is harder to predict and there could be false breakouts to the up and downside.

The June month to date high is 110.33, which provides the first point of resistance to upward movement.

The moving averages are aligned to offer bulls more comfort, the 20 daily 20 SMA, above the 50 and that above the 100. Respective support from these can currently be found at 109.579 for the 20 SMA; the 50 SMA is at 109.111 and 100 SMA at 108.802.

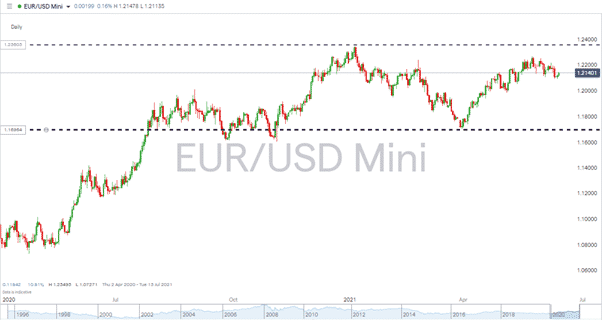

EURUSD and the Fed’s Interest Rate Decision

While the dollar has been strengthening against the yen, it’s been treading water in relation to the euro. The side-ways pattern has provided opportunities for those looking to trade long and short, and it will be interesting if that continues to be the case after the Fed’s meeting this week.

Source: IG

A break to the upside would be most likely if Fed Chair Jerome Powell locks in continued taper relief and low-interest rates. There is more room to the bottom end of the channel and a slide to the critical support – a year-to-date low of 1.168 might come about if the market interprets Powell is indeed ready to talk about a new era of interest rate policy.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk