Monday and Tuesday of this week are particularly quiet in terms of economic data releases. The lull forms a suitable introduction for the big news on Wednesday when the US Federal Reserve provides its six-weekly update on all things to do with monetary policy.

The Major News of the Coming Week

To date, the Fed has held its ground on its dovish stance and explained the current inflationary pressures as “transitory”. This despite the US economy consumer price index last week posting the largest increase for several decades. With some corners of the US economy still suffering from unemployment inertia, the market is pricing in that the Fed will stick with its current line. The opinion is that the situation will remain while the US has not recovered all its lost jobs during the pandemic.

Commentators and analysts will be considering the details of the Fed’s statements. Any hint that the use of the term ‘transitory’ is itself ‘transitory’ and that a reversal in policy is coming sooner rather than later and a significant market shake-up can be expected.

In the run-up to Wednesday’s big call, major equity indices have pushed to new highs. The FTSE 100 was up 1.54% on the week and the US S&P 500 broke to an all-time high on Friday. It appears equity investors are happy to take the Fed at its word and buy into continued loose monetary policy. The cheap money has got to go somewhere; equities are gaining from that. There were some interesting technical features to the recent strength in those indices. The trading session of Friday and Monday morning suggests there could be some support for the upward movements.

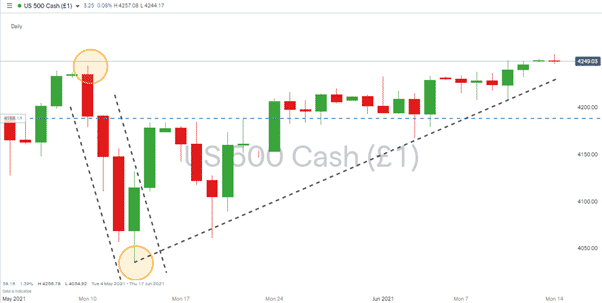

S&P 500

S&P 500 futures had an exciting time at the end of the week. During the European trading session of Friday, futures broke through the 4232 resistance, which had dogged the market for some time.

Source: IG

There was a return to kiss the 4232 level and an impressive bounce when Wall Street markets opened, with the index closing at 4245. The touch of 4232 now confirming that level as a significant support level. Monday morning has seen the markets push on, with S&P 500 futures reaching as high as 4256 in early trading.

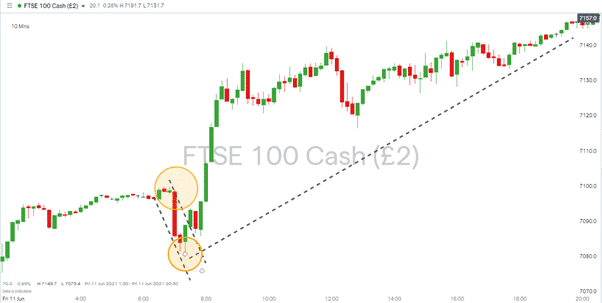

FTSE 100

The FTSE 100 followed a similar pattern on Friday. Core economic data released before the market opened was positive, but the blue-chip index lost ground in early trading. Like the S&P500 later in the day, the UK index bounced from its support and showed strength right up to the close.

Source: IG

The FTSE looks set to offer greater price volatility than the S&P 500. As the US index is more closely aligned to the US interest rate policy than its UK counterpart, there could be greater inertia in the build-up to Wednesday’s big reveal.

Source: IG

Demonstrating the potential for this to be the case, the early trading on Monday morning saw the FTSE 100 gain 0.60% and lose 0.50% in the first hour of trading.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk