If Crypto upstart Dogecoin does follow the historical path of coins newly listed on Coinbase, then its owners could be in for a treat. The premise outlined in research by blockchain analytics firm Messari is that on average, prices of coins increase by 91% in the first five days they can be traded on the Coinbase platform. As the disclaimers say, historical performance is no guarantee of future price moves, but there are some willing to take speculative positions on the back of the idea.

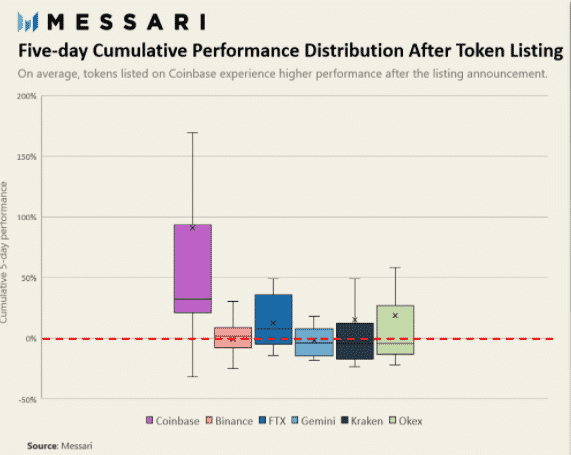

Rumours of a ‘Coinbase Effect’ date back some time. At first, it was based on anecdotal evidence pointing to coins experiencing a significant pop in price after listing on the US crypto platform. In an effort to offer greater clarity, Messari has run the numbers and drawn some quite startling conclusions.

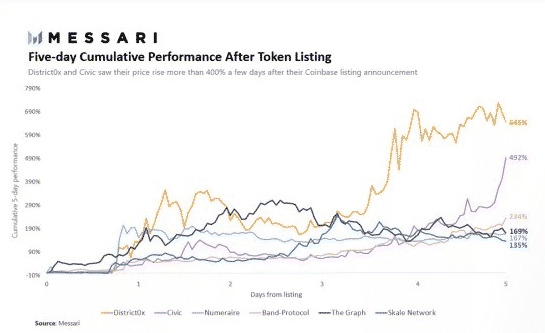

Not only is the Coinbase Effect real, but also price surges associated with that platform are much stronger than those on alternative platforms such as Binance, Gemini and Kraken. Of the exchanges in the survey, Coinbase had the highest average return over the first five days, the mean average being 91%.

Source: Medium/Messari

What Does the Coinbase Effect Mean for Doge?

The news that Doge would be supported by Coinbase from Friday 4th June initially had the desired effect. A 25% price spike into the end of the week was, however, followed by a major price slide.

Source: eToro

Analysis of the trade now depends on whether you were unfortunate enough to follow the standard Coinbase Effect playbook and bought into Doge last Friday or still have some powder dry and are looking to get in at these new low levels. It should be noted that the distribution of the Coinbase Effect ranges from -32% to 645%. Doge at this stage looks like it could be an outlier to the downside.

If the self-fulfilling prophecy does come good, then those buying Doge at levels lower than seen on Friday would be optimising their trade entry point.

Even the most ardent crypto fan would advise caution, as Doge is something of a parody of the crypto space. Its creators sold their coins long ago, and yet its resilience despite all this neglect has become its USP. The network is maintained by miners rather than any overarching bod. The participants on the framework stand to gain from its success – not its founders.

Whether this will be enough in the long run is a difficult question to answer, but for now the Coinbase Effect and short-term strategies could be the order of the day. Those looking to take positions don’t need to use Coinbase to actually book trades. While the crypto market is unregulated, there is some comfort to be taken from using a regulated broker such as eToro that covers the market.

Source: Medium/Messari

Data Check

The numbers provided by Messari stack up, but as with all data, the devil is in the detail. Notes on the protocols used include:

- Data was scrubbed to remove outliers that would be seen to be exerting extreme influence on the results.

- The removed outliers were skewed towards positive returns.

- Two examples of coins removed as outliers are district0x +645% and Civic +493%.

If you want to know more about this topic, please contact us at [email protected].

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk