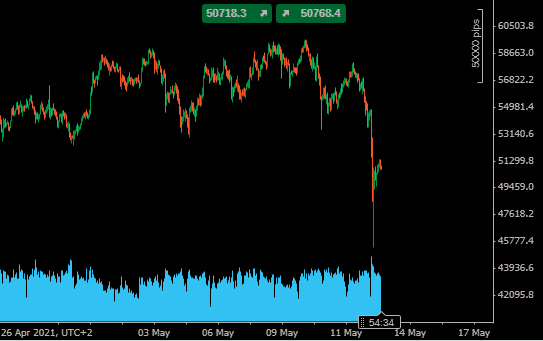

Crypto markets tanked on Wednesday after Tesla came out to say that it will stop accepting Bitcoin as a form of payment for its vehicles. The Bitcoin price in early trading on Thursday was more than 20% lower than the highpoint of Wednesday as the crypto markets lost hundreds of billions of dollars in value. The headlines will mention Elon and Tesla, but the underlying driver of the move was outlined in this report published back in April, which spotted the eco risk coming straight down the middle of the road.

Source: Pepperstone

There is some irony in the fact that such a modern and hi-tech sector as cryptocurrency has been dragged down by coal, a material primarily responsible for the industrial revolution of the nineteenth century. The energy source that made modern life and work patterns what they are could be about to scupper the currency of the future.

China accounts for 75% of the world’s Bitcoin mining and most of the power-hungry processing is fuelled by coal-fired power stations. In his Tweet, which caused the price crash, Musk explained the thinking behind Tesla’s move:

“We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel … Cryptocurrency is a good idea… but this cannot come at great cost to the environment.”

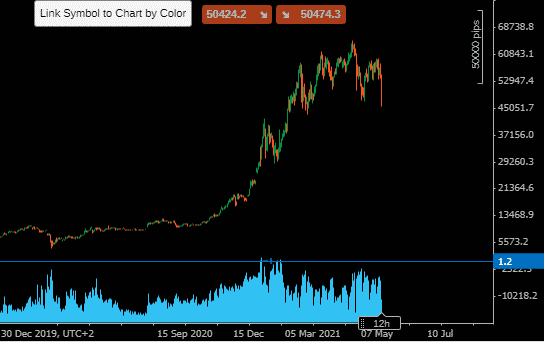

The shock associated with Tesla’s decision was magnified because the new-age vehicle manufacturer had as recently as February been the global champion for Bitcoin’s use as a means of exchange. It announced it had purchased $1.5bn of BTC and planned to accept the cryptocurrency as payment for its vehicles.

Bitcoin’s function as a store of wealth is much easier to argue than its use in actually buying things, mainly because payment processing times can be over 10 minutes long. To date, investors in BTC have been happy to hold positions on the basis that the processing times will either be resolved or are less important than some analysts make out. This curveball from Musk opens up to public view a previously underrated threat.

By the time European markets opened on Thursday, Bitcoin had recovered some ground from the $46k lows and had scrambled above the key $50k level. Everyone will be waiting to see if that price support holds. Tesla itself has stated it won’t yet be heading for the door.

“Tesla will not be selling any Bitcoin and we intend to use it for transactions as soon as mining transitions to more sustainable energy.”

But they might have started a rush to new Alt-coins. Musk has been able to cause dramatic price swings in crypto markets and could have just started another new craze. Text in the Tweet could have started the hunt among crypto fans for the greenest coin. The comment provides a clue as to how to identify which crypto may be about to get the backing of the most influential player in the market.

“We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

Source: Pepperstone

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk