Pros:

- Over 100 assets available to trade

- Several different ways to deposit

- Exceptionally high level of leverage

Cons:

- MetaTrader 5 not available

- Bronze account does not have many features on offer

Those looking for a broker certainly shouldn’t discount Apollo Finances – although there are also some reasons to think twice. When it comes to the positives, this is certainly a broker which puts choice at the heart of its offer. From a diverse instrument selection to a very wide spectrum of trading conditions when it comes to account types, finding the bespoke trading situation that is right for you is probably possible here. And with a mobile trading option and various customer service methods on offer, customer experience is clearly at the heart of business.

There are some drawbacks to using this broker, though. It doesn’t appear to offer a demo account, and its educational provision is thin on the ground. US clients can’t participate, although that is far from uncommon in the sector. And MetaTrader 5, which is the latest iteration of the commonly-used MetaTrader platform and a step up in terms of features, is not on offer here. There may also be some concern around the fact that the broker does not provide clear information about where – and by whom – it is regulated, which could be interpreted by some traders as a warning sign.

Ultimately, trading is about finding a broker which matches your needs. Those who are comfortable with the provisions this broker has in place might go ahead and have a wonderful trading experience, and those who require something more will need to look elsewhere. Making an informed choice using a review like this one is key.

About

The broker is based in the Republic of the Marshall Islands. It’s owned by MGX Consalt Group LTD, and the company’s registration number is 106986. Traders should be aware of the fact that the broker does not appear to display details of which regulator it is overseen by on its website. That is not necessarily a reason not to trade with Apollo Finances, but it does mean the broker requires more investigation before proceeding.

Who does Apollo Finances appeal to?

As a broker, Apollo Finances is likely to appeal to a whole host of different traders. Those who want to have a choice of asset classes to trade will appreciate the fact that Apollo Finances is multi-asset and that it offers everything from forex pairs to indices.

Apollo Finances is also likely to appeal to those traders who find themselves wanting more choice when it comes to their account type. As will be explained below, the spectrum of account types is very wide – and there’s something for everybody whether they are looking to make a high-spread, low-deposit investment or whether they want the full potential benefit – and risk – of a big margin.

However, Apollo Finances is – on the whole – a versatile broker which carries a lot of appeal. People of all sorts of different backgrounds and approaches are likely to want to use this broker.

Account types

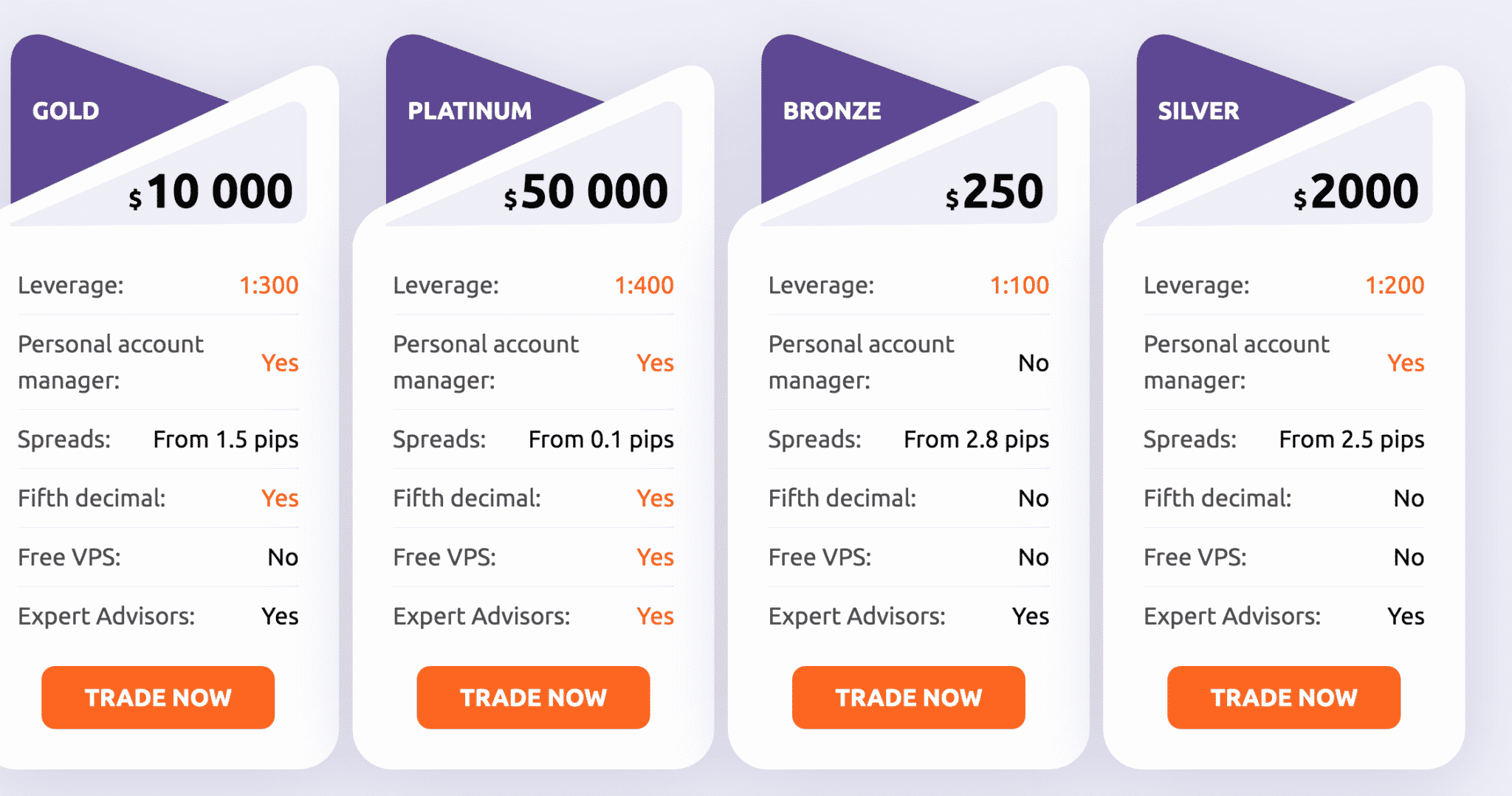

A trader signing up to Apollo Finances for the first time will have a wide variety of choice when it comes to account types. Spreads won’t be discussed in this section of this Apollo Finances review and will instead be explored further down in the relevant section.

The first account type on offer at this broker is the Bronze account: this account comes with a basic level of leverage at 1:100, so it may not be suitable for those traders who are looking to rely heavily on margin trading to boost their deposits. Those who are looking to use a VPS for free cannot do so with a bronze account, and there’s also no “fifth decimal” trading available with this account. On the whole, this is a somewhat disappointing array of features even for an entry-level account. It is possible, however, to use Expert Advisors when trading with this account – and the minimum deposit rate rests at just $250, meaning the barriers to entry are low.

The benefits of trading at Apollo Finances quickly pick up as the trader proceeds up the account type hierarchy. The Silver account offers double the amount of leverage, and there’s also a personal account manager available – although the minimum deposit needed does skyrocket to $2,000. Gold accounts allow for leverage of 1:300, although the minimum deposit level is much higher and does not increase proportionately to the deposit rates: for this account, $10,000 must be put down – although fifth decimal trading is now permitted.

Finally, the Platinum account at Apollo Finances is useful for those who want to trade using huge levels of leverage. This account offers a leverage rate of 1:400, and traders must put down a minimum deposit of $50,000. All features are made available to traders who take up this account.

Markets and territories

Perhaps the main omission on this list is the US. While this could be frustrating to traders based in the US, it is quite common for brokers to turn away clients who are based there for a whole host of complex reasons. As a result, this is not a disadvantage of this broker in particular.

Instruments and spreads

There are lots of different instruments on offer at this broker, and traders are likely to find themselves spoilt for choice. In total, there are over 100 assets to pick from. They can be split into sub-categories commonly found in the broker world, such as currency pairs and energies. Also represented are indices, metals, futures and shares. The broker offers assets on a contracts for difference, or CFD, basis.

The spreads – which is the difference between the buy and sell price – that traders are likely to find can vary depending on the asset class, account type and also on the time at which they trade.

Fees and commissions

Apollo Finances uses the money-making model employed by many of the brokers operating in this space: calculating a spread, as outlined above, and then charging a fee from there. This fee changes depending on a number of different factors, and it’s not guaranteed that any two traders will experience the same exact combination of spread fees.

It varies depending on assets, for a start. It also varies depending on the account type the trader opts for. Those who choose the bronze account will see spread fees starting at 2.8 pips, while those who go for silver will see their fees start at 2.5 pips. Opting for an account type further up the hierarchy will give traders the chance to trade on spreads starting at 1.5 pips, and super-thin spreads – of 0.1 pips – will be available for platinum account holders.

Overall, this is quite a common approach. Traders will experience this kind of offer from most major brokers. The spread fees are not necessarily the cheapest on the market, and it might be possible to have a more cost-effective trading experience elsewhere: however, they’re also not extortionate compared to some other brokers on the market.

Some traders might prefer to trade on a commission basis: this does not appear to be an option at this broker. Traders should be aware that this broker charges withdrawal fees in some circumstances. Wire transfers, for example, could incur a $20 charge.

Platform review

In terms of the platforms offered, Apollo Finances has a satisfactory range. The broker’s offer is anchored around MetaTrader 4, which is perhaps the most recognisable name in the industry. This is a standard software package for traders, but it is also a useful one which is jam-packed with a variety of excellent features. These include 2,000 free custom indicators, capacity for hedging, and much more.

Traders will also be pleased to see that they can access MetaTrader 4 through a number of different routes when trading with this broker. The main way to use the platform is to access it via the terminal function, but this involves downloading a software package and using a lot of computing power. As a result, many traders prefer to go for the web trader function, which allows the trader’s account to be accessed without having to download software or similar.

Another alternative is to download the mobile phone app and trade on the go. This review will share more information in that in a moment. Those who have a Mac and use Apple’s operating system can also download an OS-specific tool for their computers.

Finally, it’s important to clarify that the latest version of MetaTrader, MetaTrader 5, is not available at this broker. In most cases, this is unlikely to be a huge problem for a trader: MetaTrader 4 still has so many benefits. But some subtle differences between the two iterations of the platform. MetaTrader 5, for example, accepts netting and has a multi-threaded strategy tester rather than a single threaded one.

Mobile trading

Helpfully, this broker offers a mobile trading app. This is again anchored around MetaTrader and can be downloaded for both Android and iOS. It’s important to note, though, that some of the features offered on the desktop versions are not available on the mobile versions. Expert Advisors, for example, cannot be run via mobile.

Social trading and copy trading

Providers in the trading sector are increasingly offering traders the chance to engage in what are known as “social trading” tactics. This involves agreeing to copy the trades of more experienced or otherwise successful traders. The trader being copied can receive some sort of commission for participating in the scheme. Unfortunately, it appears that Apollo Finances does not offer this service at the present time.

Crypto

Cryptocurrencies are becoming increasingly popular across the board, and this asset class is one that many traders might look to invest in given the potential for high returns – although these are of course not guaranteed. It does not appear that Apollo Finances offer this as an asset class, so those looking to expand their portfolio with cryptocurrencies will most likely need to go elsewhere.

Charting and tools

The charting options and trading tools on offer at Apollo Finances are anchored largely around the MetaTrader platform which the broker uses. In terms of charting, MetaTrader 4 offers nine different timeframes, for example, and 30 built in indicators. The platform also offers more general tools designed to help a trader get the information they need into a position that works for them. These include table reporting and four different order types.

Education

For many traders, working with a broker is not just a way to gain access to the markets. It’s also a way of developing your trading skills, perhaps before going on to a full career in finance or similar. For that reason, traders often look out for educational tools which give them the chance to learn more about the sector.

Sadly, it appears that there is no education provision at Apollo Finances. Usually, this sort of content is available in a number of formats such as text and video. But there is no section on the Apollo Finances website offering even basic articles, let alone anything like an economic calendar or a series of trading tutorials. This could be a big drawback for those traders who are looking to enhance their trading education and could drive them to go elsewhere.

Some traders also decide to “learn by doing” in a risk free environment before they make their first deposit. Usually, this takes place in a sandbox-style environment known as a demo account in which there is no real money changing hands and no chance of an actual financial gain or loss. The Apollo Finances website is unclear about whether it offers traders this particular opportunity for strategic experimentation: it does state that it offers a “real account” and appears to criticise the idea of a demo account. It says that it instead offers educational tools, but there is no clear link to these to be found.

Trader protections by territory

It’s difficult to ascertain what territory-specific steps Apollo Finances takes to protect traders. For those who want to know exactly how the broker will protect them in their own country, this may be a deal breaker. However, there is some information available on how the broker protects all traders no matter where they are based.

The broker makes clear on its “Deposit” page, for example, that it “segregates” client funds – which means it puts them into a different fund to the one it uses for its own operational costs. It says that it stores money in top-tier banks which are suitable for investment purposes. It also says on this page that it carries out processes each day to confirm that there is enough capital available.

The broker also has a detailed risk warning in various places on its website. This advises traders to ensure that they comprehend what could happen if their investment does not pan out the way they envisage, and to make sure they have an adequate understanding of the risks of loss. It also has a policy in its documents section which explains what steps it intends to take to combat money laundering.

As mentioned elsewhere in this review, some traders are likely to find the lack of clear information about which exact regulators oversee the broker’s activity a little concerning. However, the commitment made on the broker’s website to principles like segregated funds may reassure traders somewhat.

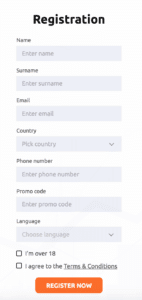

How to open an account

Opening an account at Apollo Finances is easy. This stands in contrast to some other brokers on the market, who are notorious for providing a complicated user experience that ends up dissuading potential traders rather than encouraging them to participate.

At Apollo Finances, a new trader needs to go to the prominent “sign up” button in the top right hand corner of the page and click on it. From there they will be asked to fill out a short form

Perhaps the more complicated part of the process comes later. That’s the deposit stage: transferring cash into an Apollo Finances account requires the trader to jump through a number of hoops, such as verification. This, however, is a regulatory requirement and not something that is specific to Apollo Finances, and it’s likely to be the same at most other brokers.

Customer support

Convenience and choice is clearly the name of the game with this broker, however, as there are other contact options to pick from too. One of these is telephone: to speak to someone, traders can call +442030974723.

Apollo Finances is a brand name, and the brand is owned by MGX Consalt Group LTD. It’s even possible to contact MGX Consalt Group LTD by post, although it’s not advisable given the convenience of the other customer contact options. The address is Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands, MH 96960. While it may be unlikely that a customer will take up the offer to send a physical letter or similar, the provision of these details is a reassuring sign.

The bottom line

Apollo Finances is certainly far from being a terrible broker. It has plenty of features designed to get traders on board, including an impressive array of asset classes as well as a selection of customer service contact routes to pick from.

The broker lets itself down in a number of ways. It doesn’t, for example, offer MetaTrader 5, and the account types at the lower end of its account type hierarchy are not hugely appealing given the limitations on features. A lot of traders may be put off by the fact that the broker does not carry prominent information about which regulatory oversees it, too. But on the whole, this broker does have something to offer traders – and it should be considered as an option by those looking to invest.

FAQs

How can I open a demo account with Apollo Finances?

It appears that this broker does not offer a demo account.

How can I open an account with Apollo Finances?

A trader looking to open an account with Apollo Finances can go to the “Sign up” button in the top right hand corner and fill out the relevant form.

What are the deposit options for Apollo Finances?

You can make a deposit at Apollo Finances using one of various different methods, although the exact offer varies based on country. Often, the list will include Visa, MasterCard and wire transfer.

How can I change leverage with Apollo Finances?

In order to change the amount of leverage you have available, it’s best to swap account types to one that has the right level for your needs. There are four account types to select from.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk