It’s time to prepare for a hectic week in terms of data announcements. A flurry of economic and corporate data is set to fall across markets that have seen a determined move into risk in the last week. Hourly and daily technical indicators are indicating ‘Strong Buy’ across the board.

Bitcoin is the only one that lags the group, some of its weakness being attributed to the upstart crypto Dogecoin showing signs of being a potential threat to BTC’s dominance of the sector. That asset’s role as an outlier is making most investors look to forex, commodity and equity markets for signposts of future moves.

| Instrument | Price 19/4 | Hourly | Daily |

| GBP/USD | 1.3870 | Strong Buy | Strong Buy |

| EUR/USD | 1.2008 | Strong Buy | Strong Buy |

| FTSE 100 | 7,031 | Strong Buy | Strong Buy |

| S&P 500 | 4,180 | Strong Buy | Strong Buy |

| Gold | 1,786 | Strong Buy | Strong Buy |

| Silver | 2,603 | Strong Buy | Strong Buy |

| Crude Oil WTI | 63.19 | Neutral | Strong Buy |

| Bitcoin | 57,385 | Strong Buy | Sell |

Source: Forex Traders Technical Analysis

Much of the upcoming data looks likely to influence EURGBP prices. The ECB gives its update on interest rate policy later in the week, but before they come to the markets, the central banks of Australia and Canada will set the mood. Both the UK and Eurozone also release a slew of reports relating to the prospects for their economies. Reports on inflation, interest rates, unemployment, consumer confidence and corporate earnings are all about to hit the market

EURGBP – Economic Data for the Week Ahead

Tuesday

- RBA – meeting minutes

- China – Loan Prime Rate

- Germany Producers Price Index

- UK Unemployment Rate

Wednesday

- UK – CPI, PPI, RPI

- Bank of Canada – interest rate decision

Thursday

- European Central Bank – interest rate decision

- Eurozone – consumer confidence

- UK – CBI industrial trends

- US – initial jobless claims

Friday

- UK – consumer confidence and retail sales

- Eurozone & UK – Markit manufacturing and services PMI

Factor in the US earnings season and its ability to act as a bellwether for the global markets, and it’s clear that some thought needs to be given to how to navigate the next few data-driven days.

Key US earnings data point: Netflix Q1 data on Tuesday

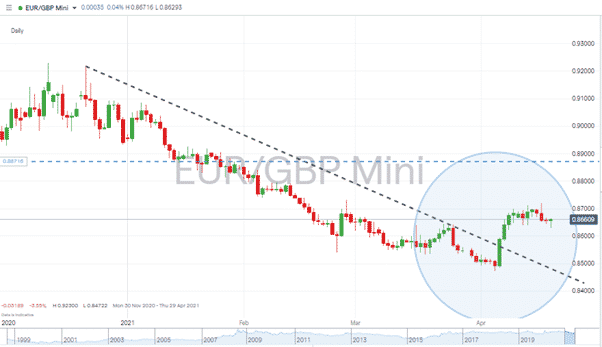

EURGBP in Focus

Source: IG

The relative strength of sterling over the euro has been the major trend for 2021. Primarily based on the relative speeds of vaccine roll-outs, investors flocked to GBP as it looked set to break out of lockdown sooner than its European counterparts.

The break of the downward trend line in April is attributed mainly to EU governments and the ECB making it clear that their fiscal and monetary stimulus can continue to operate for as long as it takes to get back to normality. The question of whether that promise is enough to continue sending the euro higher looks set to be at least partially answered this week.

EURGBP is stalling at the 87p mark, and a break of 86.3p would indicate a resumption of the December – April downward trend. With so much data due to be released, there could be false break-outs. The ECB’s announcement on Thursday is the key data point to watch.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk