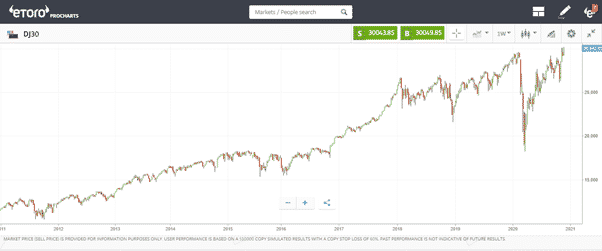

The Dow Jones Industrial Average has broken the 30,000 level for the first time. The significance of the event was marked by President Donald Trump, who gave a brief unscheduled press conference. He entered the meeting room, made his announcement, and then within one minute had vanished without taking any questions.

There will be a lot of questions asked about what the Dow’s record-breaking price spike could ‘really’ mean. It’s certainly not an event which can be easily dismissed. For many, it means climb on board because the equity train is leaving the station.

Source: eToro

This historical move and the shattering of the psychologically important 30,000 level generated news reports which have crossed from financial to mainstream media.

It could be the catalyst for more support from retail investors. A groundswell of an increased appetite for equities across a broad base is what gets equity markets moving.

Is now the time to buy the Dow?

It is, unfortunately, often the case that retail investors join the party late and sometimes lose out when the correction ultimately comes.

On the other hand, the break of 30,000 could be a trigger for increased buying interest from people bringing new money into the markets.

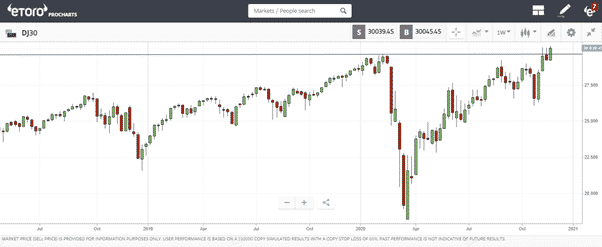

Source: eToro

Those looking to put on a momentum trade based on catching the influx of new interest would still want to find an optimal entry point. The longer-term trade possibly requiring a short-term pullback – which might be on the cards.

The Dow Jones RSI of 64 is beginning to show signs of waning momentum. During the opening of European markets on Wednesday, the DJIA futures were in the red while S&P 500 and Nasdaq 100 futures were still in positive territory.

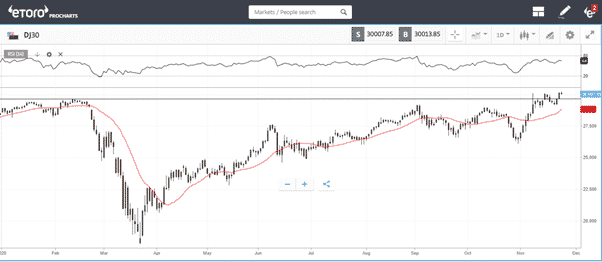

Those looking to buy-a-dip might be looking for an entry point near the Daily 20 SMA, currently trading at 28,806.

Source: eToro

The Dow’s rally through November puts it in line to post its largest monthly percentage rise for 33 years. It’s currently up 13% month-to-date with the US Thanksgiving holiday likely to be a time of price consolidation as the market’s movers and shakers take some time off.

Budget-priced value stocks have become this month’s fashion item, and a rotation into the Dow reflects investor optimism that the worst of the COVID pandemic might be over.

One other revelatory feature of the Dow’s progress has been that it does contain its fair share of stocks which can sprinkle a little stardust.

Pfizer (NYSE: PFE) and Johnson & Johnson (NYSE: JNJ) operate in sectors well positioned to benefit from a focus on healthcare.

There are more cutting-edge names in the Dow than in other ‘traditional industry’ indices, such as the FTSE 100 and DAX 30. Apple, Disney, IBM, Intel and Microsoft are all constituents of the DJIA.

Investors who have looked under the bonnet and seen what makes up the DJIA may have concluded that the index offers exposure to a broad range of sectors. Even without the end of lockdown, with tech-stocks at potentially inflated levels, the DJIA would be a sensible choice for them.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk