The immediate reaction to Pfizer’s announcement on Monday resembled that of a grenade going off in the global financial markets. Since then, some of the asset groups, like WTI Crude oil, have held the price levels they quickly reached. Some have retraced (US Tech) and some continue to move with vaccine driven momentum (EURUSD). The aftershocks are throwing up interesting trading opportunities across all markets.

Trading the Vaccine News Using RSI

Technical analysts will be all too aware that the Pfizer vaccine is a gamechanger. If you’re building strategies based on historical price data, then having a paradigm shift during that data collection period limits the effectiveness of models.

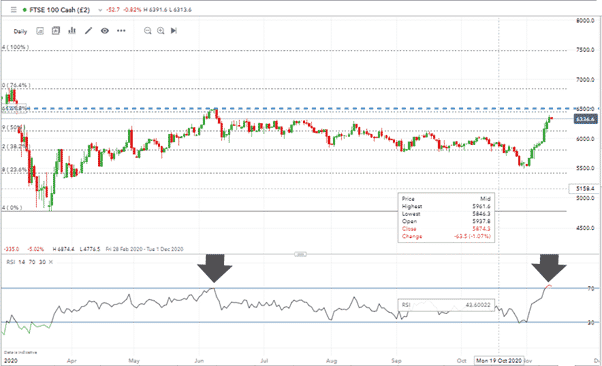

That said, the FTSE 100 RSI has breached the 70 level for the first time since the 8th of June.

Back in June, the index gave up 8.44% in the three trading sessions that followed the breach of RSI 70.

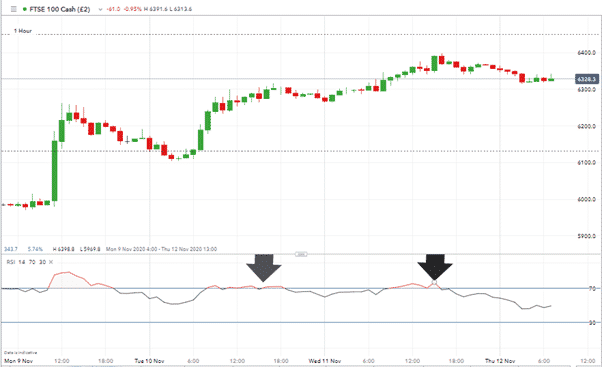

Thursday’s session comes on the back of nine consecutive up days for the FTSE 100. In early European trading, the UK equity benchmark index is forming a price consolidation pattern.

It might be too early to sell-short, particularly for those using short time-frame based strategies. The hourly chart shows that in the 1H time-frame the RSI has for days been happily motoring on above RSI 70 with little sign of a sell-off.

Short-selling might be for those with more patience and wider stop-losses. There is, however, added risk associated with the weekend approaching.

News flow relating to COVID and the vaccine is currently positive in tone. Any announcement by a second pharma-giant that it also has a vaccine ready to roll out could bring about another surge.

Wednesday saw the UK announce that it had recorded its 50,000th death from the virus. A grim milestone but one which the market shrugged off. All eyes remain fixed on Pfizer, not fatalities.

EURGBP

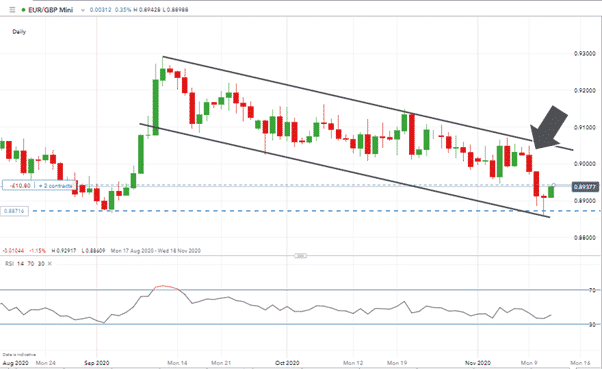

The Pfizer announcement acted as a catalyst for a sterling – euro divergence. Given that the COVID vaccine would be likely to benefit the eurozone and UK economies equally, this raises some interesting questions.

The EURGBP pair has been following a downward channel since the 11th of September. That seems to be based on the view that Brexit negotiations could be heading towards a resolution which would favour the UK.

However valid that argument, the shift from the top end of the channel to the lower one in just two trading sessions and off the back of vaccine news, has seen traders begin to buy EURUSD on Thursday morning.

Momentum appears to be building. The butterfly doji of Wednesday touched 0.88581, the lower trend line, before shooting back to close at 0.89079. Just after the open on Thursday EURUSD is at 0.89367 with the upper trend line resistance sitting above 0.90.

Over a longer time frame, the 0.88581 support looks even more significant. It marks the 6-month low with that level being skimmed in June and September and on both occasions holding firm.

Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk