The United States Dollar/Japanese Yen currency pair (also referred to as USDJPY and USD/JPY) is one of the most popular traded currencies. In this article, we will examine how USDJPY is performing.

USDJPY Key Stats

- 2021 high: 115.52

- 2021 low: 102.59

- YTD high: 145.90

- YTD low: 113.47

- YTD % change: +24.22%

USDJPY Forecast

Given the macroeconomic factors affecting the USDJPY at this present time, it seems unwise to provide any thoughts on the potential directions. The uncertainty provided by the BoJ intervention means risk to the downside is increased, but the current market environment suggests a further move higher. Therefore, for now, we are neutral on the pair.

USDJPY Fundamental Analysis

Investors are primarily influenced by significant economic changes and geopolitical events. These factors help to drive the general direction of a currency pair. In addition, data releases that affect monetary policy or general economic activity can change the overall investor sentiment. Therefore, it is an aspect of the market that all investors and traders must consider when entering, exiting, or holding positions in forex pairs.

Focusing on the US dollar, it is the go-to safe haven during weaker sentiment in the broader economy due to its economic resilience and the fact it is the world reserve currency. For those reasons, it has gained the nickname “king dollar.”

For the USD, market participants should watch out for the major economic data releases occurring weekly and monthly. Data releases such as payroll data, GDP, retail sales, consumer price index, and much more will determine how the dollar moves. These releases help market participants gain a deeper perspective on the current health of the US economy. As a result, its data releases can have a knock-on effect on the global economy. As of now, inflation has been a critical issue in the US. It moved lower to 8.3% at the last reading, indicating the Fed’s rate hike program is influencing soaring prices. However, some suggest inflation is not falling fast enough and expect the Fed to continue raising rates. Therefore, investors are pricing further hikes as the USD continues its bullish run.

Related Articles

- USD/SGD Forecast and Live Chart

- USDPHP Forecast and Live Chart

- JPY/USD at 104.5, USDX Clings On – Election in Focus

As for the Japanese Yen, several factors drive the currency’s price. Firstly, major economic data releases are just as key for Japan. This is because the BoJ policy drives carry trades across the world. Furthermore, with its extremely low-interest rates, Japan has been a significant source of capital for trade. However, with soaring inflation, those low interest rates have seen the currency weaken significantly this year as the BoJ has not increased rate to combat inflation. As a result, the BoJ has recently intervened in the currency markets to strengthen the yen to keep the currency stable while maintaining low rates.

USDJPY Technical Analysis

Technical analysis is just as important as the fundamental side; it can determine how best to enter and exit a trade. Levels and indicators can influence the price of a currency pair.

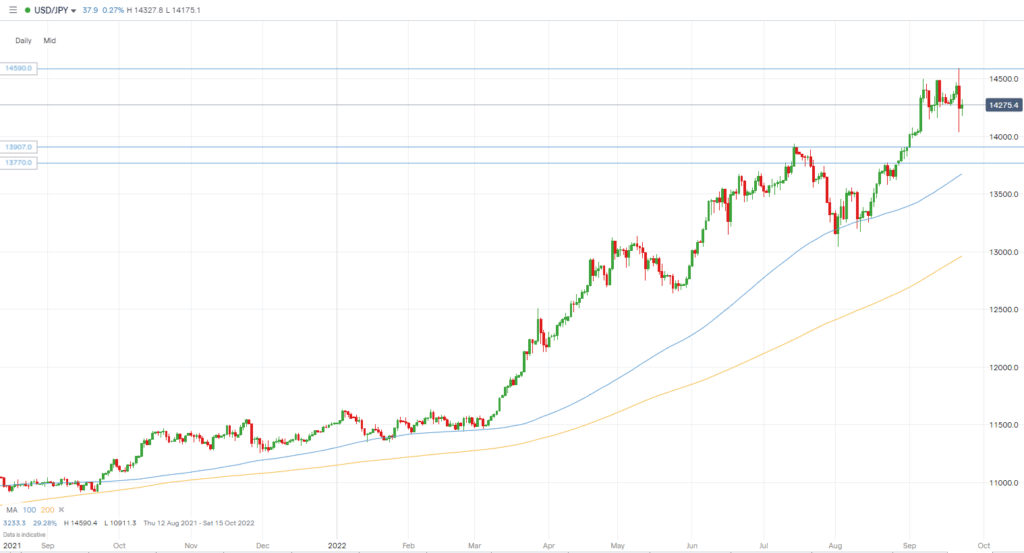

The USDJPY is on a significant bullish run meaning support levels could be key areas to watch for a potential pullback. As of now, some key support levels include 139.07 and 137.70. These levels are ones to watch if the price of USDJPY is able to pull back and test them, which may well occur despite the bull run as the BoJ intervenes further.

However, if the BoJ cannot halt the continued move higher, resistance levels can be used as areas for price targets if you have a bullish thesis. For now, level 145.90 should be watched as it is the pair’s most recent high.

Looking at the chart, the 100 MA on the daily chart has acted as a strong support level, and with the price well above the moving average, it could be an area to target for a near-term pullback.

Trade USDJPY with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.