The United States Dollar/Canadian Dollar currency pair (also referred to as USDCAD and USD/CAD) is one of the most popular traded currencies. In this article, we will examine how USDCAD is performing.

USDCAD Key Stats

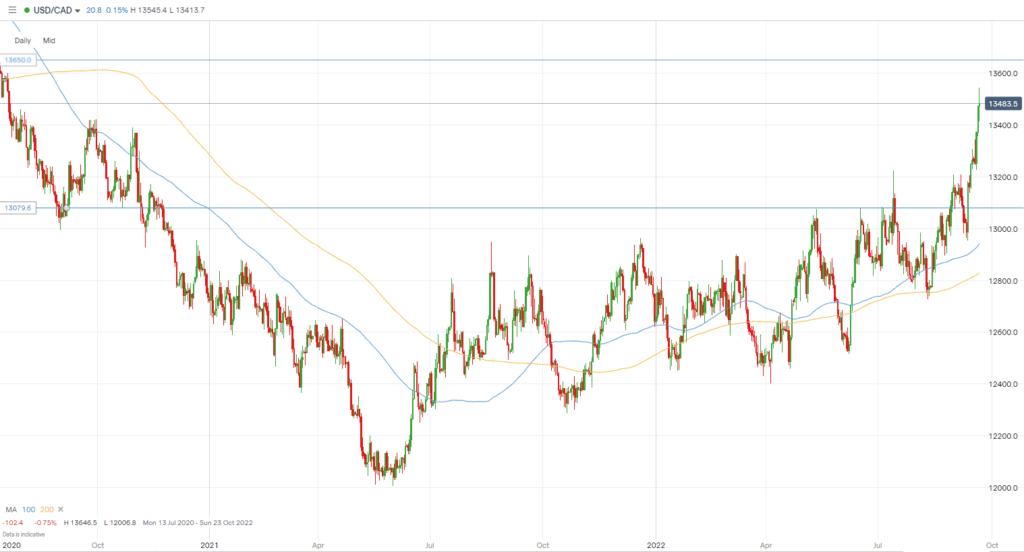

- 2021 high: 1.2963

- 2021 low: 1.2006

- YTD high: 1.3223

- YTD low: 1.2402

- YTD % change: 4.45%

USDCAD Forecast

The current macroeconomic conditions suggest some strength is still left in the dollar’s bullish charge. Despite already climbing significantly this year against most other pairs, we believe there is still room higher in the USDCAD, especially as macro headwinds continue to hamper economic growth. As a result, in the near term, we definitely see the price moving towards the 1.3650 area.

USDCAD Fundamental Analysis

Any fundamental news, such as changes in economic activity, monetary actions, or major data releases, can change the overall direction of a currency pair. As a result, fundamental analysis is a tool used by many successful traders and investors.

During times of weaker macroeconomic sentiment, the USD is considered a safe haven. The strength of the US economy and the currency’s world reserve status has seen it branded “king dollar.”

Related Articles

For the USD, you must keep an eye on major economic data releases that occur weekly and monthly. Each month we see releases such as payroll data, GDP, retail sales, consumer price index, and much more that are all drivers of the US economy. These releases help market participants gain a fresh perspective on the current health of the US economy. As a result, if the dollar has a positive release, it will usually positively affect its exchange rate compared to other currencies. As of now, inflation has been a key issue in the US, although it moved lower to 8.3% at the last reading, which may indicate the Fed’s rate hike program is having an impact. Some suggest inflation is not falling fast enough and expect the Fed to continue raising rates.

The Canadian Dollar often has a positive correlation to the price of oil. This comes from the fact Canada’s most significant earnings come from the sale of crude oil, as it is one of the largest producers and exporters of the commodity. As we have seen this year, the CAD benefits when oil prices rise. However, Canada is also facing inflation issues stemming from Covid-19 related issues. Inflation in Canada is currently at 7%, easing from the previous 7.6%.

USDCAD Technical Analysis

Technical analysis is just as critical as the fundamental side, helping traders to determine how best to enter and exit a trade. Support levels help bullish traders find areas where price may bounce and move higher. It can be used as a price floor for entry or exit levels.

Looking at the USDCAD after such a bullish run in 2022, many support levels are available. Levels such as 1.3080 and 1.2625 are decisive support levels for bullish investors hoping to get in on the pullback. However, it may be a while before the price pulls back this far after an incredible run by the USD, which doesn’t look like ending yet.

On the other hand, resistance levels help bearish traders find entries where the price may have reached its highs or pulled back. It is used as a price ceiling and can be an excellent investment technique. As for the USDCAD, a few resistance levels may stand out for traders. Level 1.3650 is one to watch and may be tested over the coming weeks. Above that, level 1.3709 will be key if the USD continues its charge higher.

The price is currently well above its 200 MA. While this suggests we could see a pullback in the near term, as mentioned above, the bullish trend looks strong and is likely to continue.

Trade USDCAD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.